Top Industry Leaders in the Saudi Arabia Renewable Energy Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Saudi Arabia Renewable Energy industry are:

ACWA Power, Alfanar Group, Abu Dhabi Future Energy Company (Masdar), Electricite de France SA, Enel SpA, Engie SA and Riyadh Renewable Energy Co

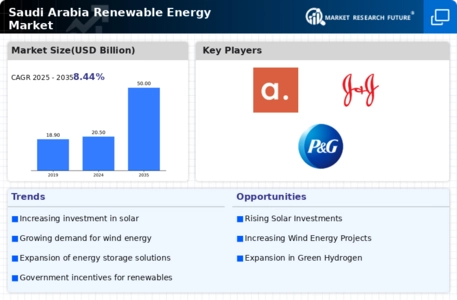

Saudi Arabia's renewable energy market is experiencing a renaissance, driven by ambitious national targets, abundant resources, and a strategic shift towards diversifying its energy mix. This has ignited a dynamic competitive landscape with diverse players vying for market share.

Key Players and Strategies:

• Local Developers: ACWA Power, a leading developer-investor, leverages its strong track record and government partnerships to secure major projects like Sakaka PV (1,200 MW) and Dumat Al-Jandal Wind (800 MW). Others like Najm Solar and Yellow Door Energy focus on distributed solar solutions, catering to growing commercial and industrial demand.

• International Developers: Global giants like EDF Renewables, Engie, and Iberdrola bring expertise and financing muscle, attracting investors through international partnerships and competitive bids. JinkoPower, a Chinese solar giant, entered the market through a joint venture with Aljomaih Holding, showcasing strategic collaborations.

• Traditional Utilities: Saudi Electricity Company (SEC), the national utility, is venturing into renewables through subsidiary SEC Renewables, while Aramco, the oil giant, has invested in utility-scale projects like Dumat wind. Their existing infrastructure and customer base offer them a unique advantage.

• Technology & Engineering Firms: International firms like GE Renewable Energy and Siemens Gamesa are providing turbines, storage solutions, and grid integration technologies, partnering with developers for project execution.

Market Share Analysis Factors:

• Financial Feasibility: Competitive bidding mechanisms like feed-in tariffs and reverse auctions are driving cost-efficiency. Players with competitive financing models and lower levelized cost of energy (LCOE) will secure projects.

• Technology Expertise: Technological advancements in renewables are rapidly evolving. Players offering innovative solutions like high-efficiency panels, hybrid projects, and advanced grid management systems will gain an edge.

• Local Presence and Partnerships: Understanding local regulations, building strong relationships with government agencies and local communities, and establishing collaborations with Saudi companies are crucial for success.

• Sustainability Focus: Compliance with environmental and social sustainability standards is becoming increasingly important. Players showcasing strong ESG credentials will attract investors and win public favor.

New and Emerging Trends:

• Shift towards Wind and Hybrids: While solar holds a dominant position, wind energy is gaining traction, with projects like Dumat Al-Jandal showcasing its potential. Hybrid projects combining solar and wind are also emerging, optimizing resource utilization.

• Local Manufacturing and Content: The government is incentivizing local production of renewable energy components to create jobs and boost domestic expertise. This will attract players with manufacturing capabilities or partnerships with local firms.

• Digitalization and AI: Integrating digital technologies and AI in project planning, operation, and maintenance is gaining ground. Players showcasing expertise in smart grids, energy forecasting, and data analytics will have an advantage.

• Storage Solutions: Battery storage and other technologies are crucial for grid stability and integration of intermittent renewables. Players offering storage solutions or partnerships with storage providers will benefit from this growing market.

Overall Competitive Scenario:

The Saudi Arabia renewable energy market is dynamic and rapidly evolving. While established players with strong track records and financial clout have an edge, adaptability to new trends, technological innovation, and strategic partnerships will be critical for long-term success. International players can leverage their expertise, but collaboration with local partners and navigating the regulatory landscape will be crucial. Local developers need to focus on cost-competitiveness and unique solutions to carve out a niche. The market presents substantial opportunities for all players, with the winners being those who embrace agility, embrace innovation, and demonstrate a commitment to building a sustainable energy future for Saudi Arabia.

Latest Company Updates:

Alfanar Group:

• October 2023: Alfanar consortium shortlisted for 1.2 GW PV tender by the Renewable Energy Project Development Office. (Source: Saudi Arabia Energy)

Riyadh Renewable Energy Co:

• October 2023: Riyadh Solar PV Project, developed by Riyadh Renewable Energy Co., starts operation. (Source: Saudi Arabia Energy)

Abu Dhabi Future Energy Company (Masdar):

• July 2023: Masdar signs MoU with Saudi Arabia's Ministry of Investment and KSA's Public Investment Fund for green hydrogen projects.