Rising Environmental Concerns

The Satellite Image Data Service Market is increasingly influenced by rising environmental concerns and the need for sustainable practices. Governments and organizations are utilizing satellite imagery to monitor deforestation, track climate change, and assess natural disasters. This trend is reflected in the growing investment in Earth observation programs, which are expected to exceed USD 30 billion by 2025. The ability to gather real-time data on environmental changes enables better policy-making and resource management. As awareness of environmental issues continues to grow, the demand for satellite imagery to support conservation efforts and compliance with environmental regulations is likely to increase, further driving the Satellite Image Data Service Market.

Growing Demand for Geospatial Data

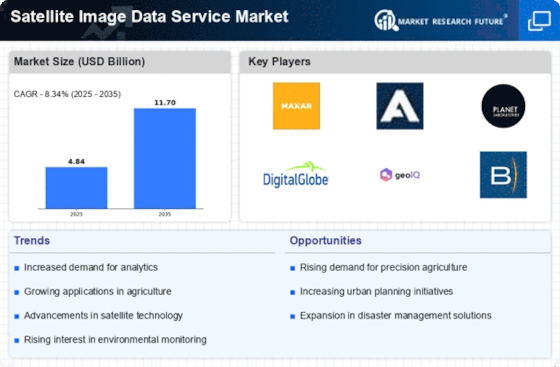

The Satellite Image Data Service Market is experiencing a notable surge in demand for geospatial data across various sectors. Industries such as agriculture, urban planning, and disaster management increasingly rely on satellite imagery for decision-making and operational efficiency. According to recent estimates, the market for geospatial data is projected to reach USD 100 billion by 2026, indicating a robust growth trajectory. This demand is driven by the need for accurate and timely information to support sustainable development and resource management. As organizations recognize the value of satellite imagery in enhancing situational awareness, the Satellite Image Data Service Market is likely to expand, offering innovative solutions tailored to specific industry needs.

Advancements in Satellite Technology

Technological innovations in satellite systems are significantly influencing the Satellite Image Data Service Market. The development of high-resolution imaging satellites and the deployment of small satellites, or CubeSats, have enhanced the quality and accessibility of satellite imagery. These advancements allow for more frequent data collection and improved image resolution, which are crucial for applications such as urban monitoring and environmental assessments. The market is expected to witness a compound annual growth rate of approximately 15% over the next five years, driven by these technological improvements. As satellite technology continues to evolve, the Satellite Image Data Service Market is poised to benefit from increased capabilities and reduced costs, making satellite imagery more accessible to a wider range of users.

Increased Investment in Defense and Security

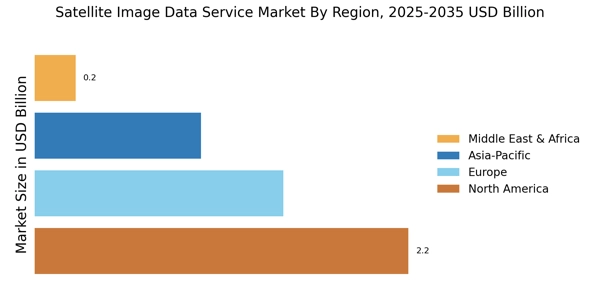

The Satellite Image Data Service Market is also benefiting from increased investment in defense and security applications. Governments worldwide are recognizing the strategic importance of satellite imagery for national security, border surveillance, and military operations. The defense sector is projected to allocate over USD 20 billion to satellite-based reconnaissance and surveillance systems by 2026. This investment is driven by the need for enhanced situational awareness and intelligence gathering capabilities. As geopolitical tensions rise, the reliance on satellite imagery for defense purposes is likely to grow, providing a significant boost to the Satellite Image Data Service Market.

Integration of Satellite Data in Smart Cities

The concept of smart cities is gaining traction, and the Satellite Image Data Service Market plays a pivotal role in this development. Urban planners and local governments are increasingly leveraging satellite imagery to enhance infrastructure planning, traffic management, and public safety. The integration of satellite data with other technologies, such as IoT and big data analytics, allows for more informed decision-making and efficient resource allocation. As cities strive to become more sustainable and livable, the demand for satellite imagery is expected to rise. The market for smart city solutions is projected to reach USD 1 trillion by 2025, indicating a substantial opportunity for the Satellite Image Data Service Market to contribute to urban development initiatives.