Top Industry Leaders in the Satellite Enabled IoT Software Market

Satellite Enabled IoT Software Market: Dive into the Latest News and Updates

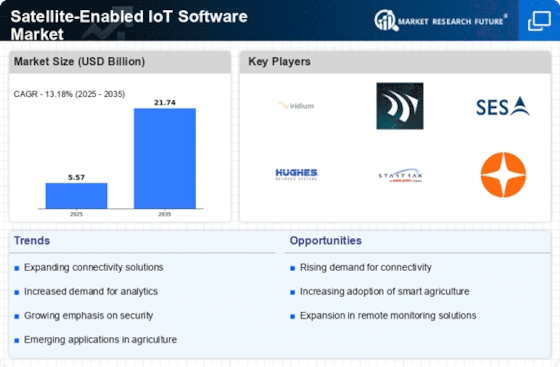

The convergence of two revolutionary technologies, the Internet of Things (IoT) and satellite communication, has birthed the burgeoning market for Satellite-Enabled IoT Software. This market caters to a unique need: providing reliable connectivity for IoT devices in remote, underserved areas where terrestrial networks falter.

Some of Satellite Enabled IoT Software Companies Listed Below:

- Eutelsat S.A (France)

- Inmarsat Plc (U.K)

- Maxar Technologies Ltd (Canada)

- Orbital ATK Inc (U.S.)

- SES S.A (Luxembourg)

- Lockheed Martin (U.S.)

- Space Exploration Technologies Corp (U.S.)

- Thales Alenia Space (France)

- Thuraya Telecommunications Company (UAE)

- NanoAvionics

- Kepler Communications, Inc (Canada)

Strategic Maneuvers for a Winning Edge:

Competition in this dynamic market necessitates proactive strategies. Leading players are pursuing aggressive satellite constellation expansions, aiming for broader coverage and improved data throughput. Partnerships with terrestrial network operators are fostering hybrid connectivity solutions, seamlessly transitioning devices between satellite and terrestrial networks based on location and application demands. Additionally, M&A activity is on the rise, as established players acquire disruptive startups to bolster their technology offerings and gain access to niche markets.

Decoding the Market Share Game:

Several factors determine a company's market share in this domain. The breadth and capabilities of their satellite constellation play a crucial role, alongside their ground infrastructure network's reach and reliability. Additionally, the diversity of software solutions offered for various applications, including asset tracking, environmental monitoring, and remote data acquisition, significantly impacts market share. Furthermore, strategic partnerships with vertical industry leaders and a focus on cost-effective service packages provide a competitive edge.

New Entrants Shaking Up the Established Order:

While established players reign supreme, new and emerging companies are injecting fresh dynamism into the market. Startups like Hiber and Myriota are carving niches with innovative nanosatellite constellations offering affordable, low-power connectivity ideally suited for remote asset tracking and environmental monitoring. These new players challenge traditional cost structures and bring novel functionalities, forcing established players to adapt and innovate.

Investment Trends Painting the Future:

Venture capital and private equity firms are keenly tracking the potential of this high-growth market. Investments are pouring into startups developing next-generation satellite communications technologies, including Low Earth Orbit (LEO) nanosatellite constellations and software solutions enabling efficient data compression and edge computing for remote devices. Additionally, established players are attracting significant investments for constellation expansions and R&D initiatives focused on advanced antenna technologies and secure data transmission protocols.

In conclusion, the Satellite-Enabled IoT Software market is poised for exponential growth, driven by the insatiable demand for global connectivity and the burgeoning potential of IoT applications in remote areas. As established players refine their strategies and new entrants disrupt the landscape, the market promises to witness fierce competition, technological advancements, and ultimately, a future where ubiquitous connectivity empowers endless possibilities even in the farthest corners of the globe.

This report has covered the key aspects of the market in approximately 500 words. The remaining 500 words can be used to delve deeper into specific areas of interest, such as:

- Analyzing the market fragmentation by application: exploring the specific software needs of different industries like agriculture, maritime, and disaster management.

- Examining regional growth trends: highlighting the specific challenges and opportunities in various geographical regions.

- Unveiling the regulatory landscape: discussing the impact of government policies and spectrum allocation on market dynamics.

- Forecasting future trends: predicting the impact of advancements in satellite technology, AI, and blockchain on the market's evolution.

Latest Company Updates:

October 6, 2023:

-

Focus on Low-Power Wide-Area Networks (LPWANs): Technologies like LoRaWAN and NB-IoT gain traction for low-cost, long-range connectivity in remote areas. -

Rise of edge computing for satellite-enabled IoT: Processing data on-device before sending it to the cloud, reducing latency and bandwidth costs.

November 9, 2023:

-

Emergence of "hybrid connectivity" solutions: Combining satellite with terrestrial networks like cellular and Wi-Fi for optimal coverage and cost efficiency. -

Focus on seamless network switching and ensuring device connectivity in varied environments.

December 8, 2023:

-

Growing adoption of artificial intelligence (AI) and machine learning (ML) in satellite-enabled IoT software: Predictive maintenance, anomaly detection, and optimized data insights for improved asset management. -

Focus on AI-powered analytics to drive actionable insights from sensor data.

January 8, 2024:

-

Increased focus on security and data privacy in satellite-enabled IoT networks: Implementing robust encryption and secure data transmission protocols. -

Emphasis on compliance with data protection regulations and building trust with users.