Growing Interest in Smart Cities

The satellite enabled-iot-software market is being propelled by the growing interest in smart city initiatives across India. Urban areas are increasingly adopting IoT solutions to enhance infrastructure, improve public services, and promote sustainability. Satellite technology plays a crucial role in enabling smart city applications, such as traffic management, waste management, and environmental monitoring. The Indian government has allocated substantial funding for smart city projects, which is expected to drive the demand for satellite-enabled IoT solutions. Market analysts suggest that the investment in smart city initiatives could lead to a growth rate of approximately 22% in the satellite enabled-iot-software market over the next few years.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation are significantly impacting the satellite enabled-iot-software market in India. Programs such as Digital India and Make in India are fostering an environment conducive to the adoption of advanced technologies. The government is investing in satellite infrastructure and providing incentives for companies to develop IoT solutions that utilize satellite connectivity. This support is likely to enhance the capabilities of various sectors, including telecommunications and agriculture, by integrating satellite-enabled IoT solutions. As a result, the market is expected to witness substantial growth, with projections indicating an increase in investment in satellite technologies by over 20% in the coming years.

Advancements in Satellite Technology

Technological advancements in satellite systems are playing a pivotal role in shaping the satellite enabled-iot-software market in India. Innovations such as miniaturized satellites and improved data transmission capabilities are enhancing the efficiency and reliability of satellite communications. These advancements enable more sectors to utilize satellite IoT solutions, particularly in remote and underserved areas where traditional connectivity options are limited. The introduction of low Earth orbit (LEO) satellites is expected to further revolutionize the market by providing low-latency communication. As a result, the market is likely to expand, with growth projections indicating a potential increase of 25% in the adoption of satellite-enabled IoT technologies in the next five years.

Increased Focus on Disaster Management

The satellite enabled-iot-software market is gaining traction due to an increased focus on disaster management in India. With the country being prone to natural disasters such as floods and earthquakes, there is a pressing need for effective monitoring and response systems. Satellite-enabled IoT solutions can provide real-time data on environmental conditions, enabling authorities to respond swiftly to emergencies. This capability is crucial for enhancing resilience and minimizing damage during disasters. The market for disaster management solutions is anticipated to grow significantly, with estimates suggesting a potential increase of 18% in the adoption of satellite technologies for this purpose over the next few years.

Rising Demand for Remote Monitoring Solutions

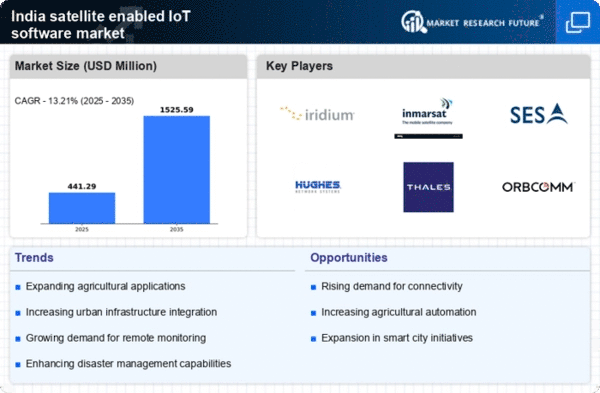

The satellite enabled-iot-software market in India is experiencing a surge in demand for remote monitoring solutions across various sectors. Industries such as agriculture, energy, and transportation are increasingly adopting these technologies to enhance operational efficiency. For instance, the agricultural sector is leveraging satellite-enabled IoT software to monitor crop health and soil conditions in real-time, which can lead to improved yields. According to recent estimates, the market for remote monitoring solutions is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates a robust interest in utilizing satellite technology to facilitate data-driven decision-making, thereby driving the growth of the satellite enabled-iot-software market in India.