Saliva Collection Devices Diagnostics Market Summary

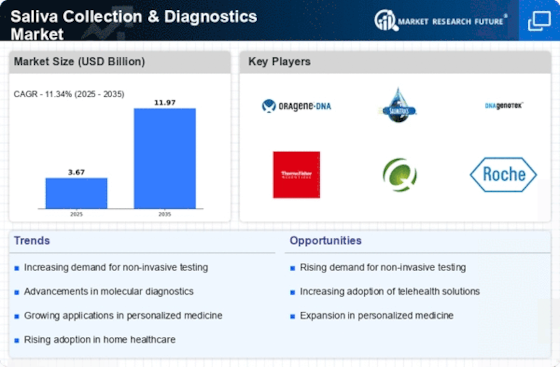

As per Market Research Future analysis, the Saliva Collection & Diagnostics Market was estimated at 3.67 USD Billion in 2024. The Saliva Collection & Diagnostics industry is projected to grow from 4.086 USD Billion in 2025 to 11.97 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.34% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Saliva Collection and Diagnostics Market is experiencing a transformative shift towards non-invasive testing and technological integration.

- The market is witnessing a rise in non-invasive testing methods, appealing to both patients and healthcare providers.

- Technological advancements in saliva collection devices are enhancing accuracy and user-friendliness, driving adoption.

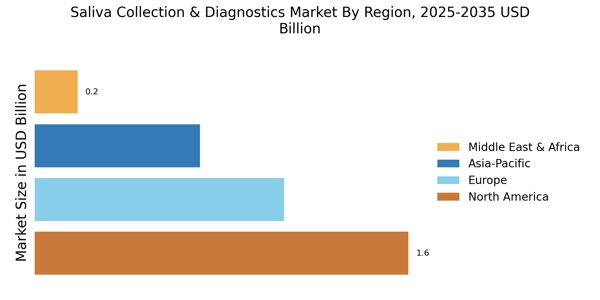

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for saliva diagnostics.

- The increasing demand for non-invasive diagnostics and the integration of saliva testing in point-of-care settings are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 3.67 (USD Billion) |

| 2035 Market Size | 11.97 (USD Billion) |

| CAGR (2025 - 2035) | 11.34% |

Major Players

Oragene (CA), Salimetrics (US), DNA Genotek (CA), Thermo Fisher Scientific (US), Quest Diagnostics (US), Roche Diagnostics (CH), Hologic (US), Abbott Laboratories (US), Genotek (US)