Growing Geriatric Population

The aging population worldwide is a crucial factor influencing the Global Sacroiliitis Treatment Market Industry. Older adults are more susceptible to musculoskeletal disorders, including sacroiliitis, due to age-related degeneration of joints and connective tissues. As the global demographic shifts towards an older population, the demand for effective treatment options is likely to escalate. This trend is particularly pronounced in developed countries, where healthcare systems are increasingly focused on managing chronic conditions in the elderly. The growing geriatric demographic is expected to significantly contribute to the market's expansion in the coming years.

Rising Healthcare Expenditure

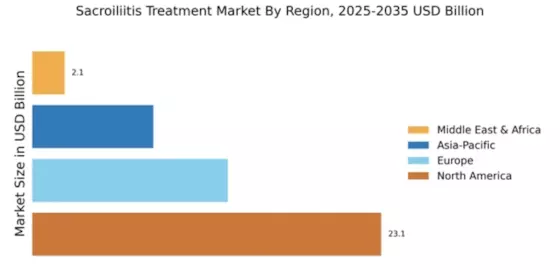

The increase in healthcare expenditure across various nations is a vital driver for the Global Sacroiliitis Treatment Market Industry. Governments and private sectors are investing more in healthcare infrastructure, leading to improved access to treatment options for patients suffering from sacroiliitis. Enhanced funding for research and development is also facilitating the introduction of innovative therapies. As healthcare systems evolve and prioritize musculoskeletal health, the market is poised for growth. This trend is particularly evident in regions with robust healthcare frameworks, where patients are more likely to receive timely and effective treatment.

Increased Awareness and Diagnosis

The heightened awareness surrounding sacroiliitis and its symptoms is a key driver of the Global Sacroiliitis Treatment Market Industry. As healthcare professionals become more adept at recognizing the condition, early diagnosis and intervention are becoming more common. This shift is likely to lead to an increase in the number of patients seeking treatment, thereby expanding the market. Educational initiatives and campaigns aimed at both healthcare providers and the public are instrumental in this regard. Consequently, the growing recognition of sacroiliitis as a significant health issue is expected to bolster treatment demand and market growth.

Rising Prevalence of Sacroiliitis

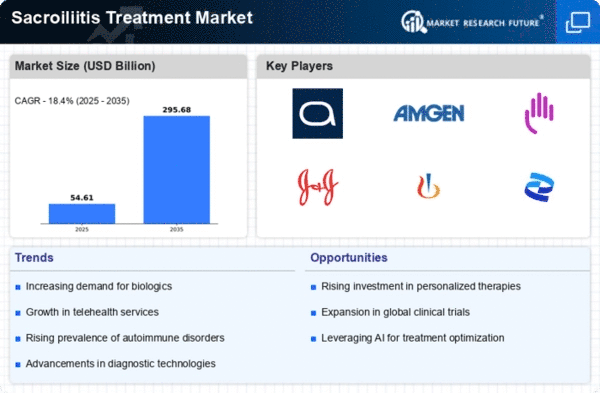

The increasing incidence of sacroiliitis globally contributes significantly to the growth of the Global Sacroiliitis Treatment Market Industry. Factors such as sedentary lifestyles, obesity, and an aging population are leading to a rise in musculoskeletal disorders, including sacroiliitis. According to recent estimates, the prevalence of sacroiliitis is expected to rise, prompting a greater demand for effective treatment options. This trend is expected to drive the market value from 46.1 USD Billion in 2024 to an anticipated 295.7 USD Billion by 2035, reflecting a robust CAGR of 18.4% from 2025 to 2035.

Advancements in Treatment Modalities

Innovations in treatment modalities for sacroiliitis are propelling the Global Sacroiliitis Treatment Market Industry forward. The introduction of biologics, targeted therapies, and minimally invasive surgical techniques has transformed the management of this condition. These advancements not only enhance patient outcomes but also reduce recovery times, thereby increasing patient satisfaction. As healthcare providers adopt these novel therapies, the market is likely to witness substantial growth. The integration of technology in treatment protocols, such as telemedicine and digital health solutions, further supports this trend, making treatments more accessible to patients worldwide.