The Russian government has implemented various policies to support the oil industry, making it a critical driver for the Russia Oilfield Services Market Industry. The government initiatives focus on providing tax breaks and incentives for oil production, as outlined in the 2020 tax maneuver, which allows for reduced taxes on oil production in harder-to-reach fields.

As a result, state-owned enterprises and private players are likely to increase their operational capabilities to capitalize on these incentives.Data from the Ministry of Finance indicates that incentives provided to the oil sector have resulted in increased investments of up to 20% annually, thereby enhancing the prospects for oilfield services across the nation.

Russia Oilfield Services Market Segment Insights

Oilfield Services Market Service Type Insights

The Russia Oilfield Services Market, particularly in the Service Type segment, showcases a diverse range of offerings critical to the efficient exploration and production of oil and gas resources. Within this sector, Well Completion Equipment and Services play a crucial role, enabling oil producers to finalize well construction and optimize hydrocarbon recovery. Meanwhile, Well Intervention Services are vital for maintaining and enhancing production from existing wells, reflecting the importance of ongoing support in maximizing yield from established resources.

The Coiled Tubing Services segment is significant, providing a flexible and efficient means of accessing wellbore, thus enhancing operational efficiency and reducing downtime during maintenance activities. Pressure Pumping Services are essential for hydraulic fracturing operations, ensuring enhanced productivity from unconventional reservoirs, which are increasingly important in Russia's oil landscape.

On the other hand, the OCTG, comprising pipes used in drilling and production operations, ensures the structural integrity necessary for safe and effective extraction processes.Wireline Services, critical for data acquisition and well evaluation, contribute to informed decision-making in drilling operations and ongoing production strategies. Overall, the Service Type orientation within the Russia Oilfield Services Market reflects an integrated approach to optimizing oilfield operations, driven by technological advancements and the necessity of maximizing production amidst evolving market conditions.

The growth dynamics of this segment align closely with the country’s strategic objectives to enhance domestic oil output and improve energy security, fostering an environment ripe for investment and innovation.As the Russian government directs focus towards improving existing infrastructure and developing new oilfields, the significance of these services only amplifies, effectively positioning them as cornerstone elements of a robust oilfield services framework aimed at driving future growth. With a comprehensive understanding of these services, Russian oil producers can navigate the challenges posed by fluctuating market conditions, and operational limitations, thereby enhancing overall operational sustainability and profitability.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Oilfield Services Market Application Insights

The Russia Oilfield Services Market focuses on various applications essential for oil exploration and production, primarily categorized into Offshore and Onshore operations. The Onshore segment is pivotal as it encompasses extensive terrestrial oil resources, benefiting from advancements in drilling technologies and enhanced oil recovery methods that improve extraction efficiency. Conversely, the Offshore operations are significant due to Russia's vast maritime territories, which require specialized services for complex underwater drilling and infrastructure development.

This segment has seen growth driven by increasing investments in offshore exploration, propelled by the need for energy security and sustainable practices. Furthermore, regulatory support aimed at boosting local production further strengthens these segments. The combination of a geographically diverse landscape and increased demand for energy resources continues to drive the dynamics of the Application segments in the Russia Oilfield Services Market.

Strengthening the capabilities in both Offshore and Onshore operations is seen as critical for meeting the energy demands while adapting to global market shifts towards cleaner energy sources and technology innovations.The segmentation offers diverse opportunities facilitating targeted investments, enhancing operational efficiencies, and ultimately contributing to the overall growth of the Russia Oilfield Services Market.

Russia Oilfield Services Market Key Players and Competitive Insights

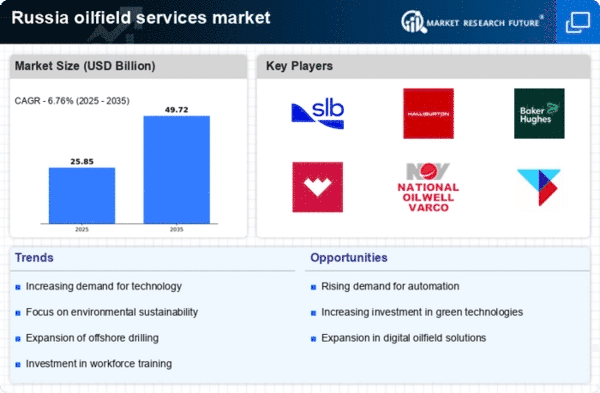

The Russia Oilfield Services Market presents a dynamic landscape characterized by a combination of domestic and international players vying for a significant share amidst fluctuating oil prices and regulatory changes. The market serves as a crucial support system for exploration and production activities, involving various services such as drilling, well completion, reservoir management, and maintenance. Competitive insights reveal a complex interrelationship between companies, influenced by technological advancements, strategic partnerships, and the evolving geopolitical context.

In this environment, firms are continuously adapting their strategies to enhance operational efficiency, achieve cost reduction, and leverage innovative technologies to remain competitive. The various service segments and geographical distribution of oil reserves create opportunities and challenges, impacting service providers' strategies as they navigate through regional complexities and market demands.

Tatneft, a prominent player in the Russia Oilfield Services Market, has established a robust market presence by leveraging its extensive expertise in oil production and field development. The company is recognized for its strong vertical integration, encompassing not only oil exploration and production but also refining and petrochemical capabilities. This integration enables Tatneft to optimize operations and reduce costs across the value chain, enhancing its competitive edge in the market.

Additionally, the firm has made significant investments in advanced technologies and innovative methods to improve efficiency in extraction techniques, thereby increasing productivity in mature fields. The backing of a solid domestic infrastructure and well-established relationships with local entities further solidifies Tatneft's position as a major influencer in the oilfield services domain within Russia.Schlumberger, a key global leader in oilfield services, also boasts a defined presence in the Russia Oilfield Services Market.

The company is recognized for its comprehensive array of services and advanced technological solutions. These services include drilling engineering, reservoir characterization, production testing, and well services that cater to both onshore and offshore operations. Schlumberger has effectively utilized its technological prowess to drive innovation in oilfield service offerings specific to the Russian market, allowing it to maintain a competitive edge.

The company has continued to engage in strategic partnerships and acquisitions aimed at bolstering its capabilities and expanding its footprint in the region. Its commitment to enhancing operational efficiency through digital transformation and automated solutions reflects its proactive approach to adapting to the evolving demands within the territory. Schlumberger's extensive portfolio and operational scalability have positioned it as a pivotal competitor in the Russian oilfield services landscape.

Key Companies in the Russia Oilfield Services Market Include

- Tatneft

- Schlumberger

- RusGidro

- Halliburton

- Acron

- Gazprom Neft

- Novatek

- Surgutneftegas

- Bashneft

- Weatherford

- Baker Hughes

- Rosneft

- East Siberian Oil Co.

- Transneft

- Lukoil

Russia Oilfield Services Market Industry Developments

In recent months, the Russia Oilfield Services Market has experienced notable developments, particularly with major companies such as Rosneft, Gazprom Neft, and Lukoil. In July 2023, Lukoil announced plans to enhance its service offering by investing in digital technologies to improve operational efficiency. Additionally, in August 2023, Gazprom Neft reported an increase in oil production, driving demand for oilfield services and spurring collaborations with firms like Halliburton for advanced extraction technologies.

Furthermore, in September 2023, Tatneft made headlines with its acquisition of a smaller oil services company, aimed at expanding its operational capabilities; this merger was significant as it reflected a strategic move to reinforce market position amidst competitive pressures.

The growth in their market capitalizations, particularly for companies like Novatek and Surgutneftegas, has been linked to rising global oil prices and a recovering demand post-pandemic, influencing the overall oilfield services landscape in Russia. Over the last two to three years, notable events such as Russia's focus on energy independence have further shaped market dynamics, with companies increasing investments in Research and Development to drive innovation.