Expansion of Off-Road Trails and Parks

The development of off-road trails and parks across Russia is significantly impacting the off road-motorcycle market. Government initiatives aimed at promoting outdoor sports and tourism have led to the establishment of numerous off-road parks, providing enthusiasts with designated areas for riding. This expansion not only enhances accessibility but also encourages participation in off-road motorcycling. Recent statistics indicate that the number of off-road parks has increased by over 15% in the last five years, creating a favorable environment for the off road-motorcycle market to thrive. As more riders seek safe and well-maintained trails, the demand for off-road motorcycles is expected to rise.

Rising Disposable Income Among Consumers

In Russia, the off road-motorcycle market is benefiting from a rise in disposable income among consumers. As economic conditions improve, more individuals are willing to invest in leisure activities, including off-road motorcycling. This trend is particularly evident among younger demographics, who prioritize experiences over material possessions. Data suggests that disposable income has increased by approximately 10% in recent years, allowing consumers to allocate funds towards recreational vehicles. This financial flexibility is likely to bolster the off road-motorcycle market, as more consumers view off-road motorcycles as viable options for adventure and leisure.

Increasing Demand for Recreational Activities

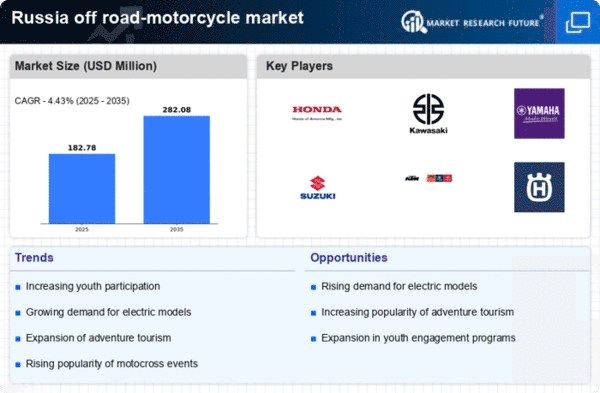

The off road-motorcycle market in Russia is experiencing a surge in demand for recreational activities. As urbanization continues to rise, individuals are increasingly seeking outdoor experiences that provide an escape from daily routines. This trend is reflected in the growing popularity of off-road motorcycling, which offers both adventure and a connection to nature. According to recent data, the market has seen an annual growth rate of approximately 8% over the past few years. This increasing interest in recreational activities is likely to drive sales in the off road-motorcycle market, as consumers invest in vehicles that enhance their outdoor experiences.

Influence of Social Media and Online Communities

The rise of social media and online communities is playing a pivotal role in shaping the off road-motorcycle market in Russia. Platforms such as Instagram and YouTube have become essential for sharing experiences, tips, and showcasing off-road adventures. This digital presence fosters a sense of community among riders, encouraging more individuals to participate in off-road motorcycling. Recent surveys indicate that approximately 60% of new riders are influenced by social media content when considering their first motorcycle purchase. This trend suggests that the off road-motorcycle market may continue to grow as online engagement drives interest and participation in the sport.

Growing Interest in Customization and Personalization

The off road-motorcycle market is witnessing a growing interest in customization and personalization among consumers in Russia. Riders are increasingly seeking unique modifications to their motorcycles, reflecting their individual styles and preferences. This trend is supported by the availability of aftermarket parts and accessories, which allow for extensive personalization. Market data indicates that the customization segment has expanded by around 12% in the last few years, as enthusiasts invest in enhancing their motorcycles. This inclination towards personalized vehicles is likely to drive sales in the off road-motorcycle market, as consumers seek to create distinctive riding experiences.