Advancements in Feed Technology

Technological innovations in feed production are transforming the Ruminant Feed Market. The introduction of precision feeding techniques and feed additives enhances the efficiency of nutrient utilization in livestock. For instance, the use of enzymes and probiotics in ruminant feed can improve digestion and overall health, leading to better growth rates and milk production. Recent studies indicate that these advancements can increase feed efficiency by up to 15%, which is crucial for farmers aiming to maximize profitability. Furthermore, the integration of data analytics and monitoring systems allows for tailored feeding strategies, optimizing the health and productivity of ruminants. As these technologies continue to evolve, they are likely to play a significant role in shaping the future of the Ruminant Feed Market.

Growing Awareness of Animal Health

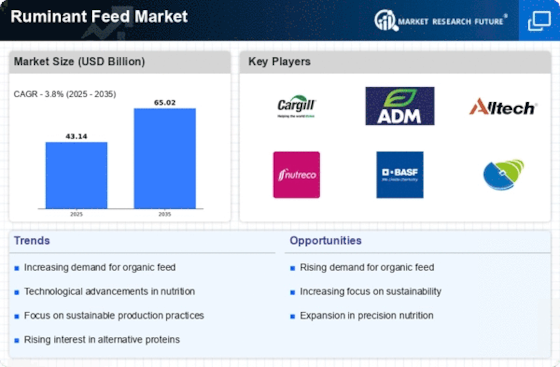

The increasing awareness of animal health and welfare is a significant driver in the Ruminant Feed Market. Consumers are becoming more conscious of the conditions under which livestock are raised, leading to a demand for higher quality feed that promotes animal well-being. This trend is reflected in the rising sales of premium feed products that are formulated to enhance health and productivity. Data suggests that the market for specialty feeds, which include organic and non-GMO options, is expanding rapidly, with a projected growth rate of around 4% annually. As farmers prioritize the health of their livestock to meet consumer expectations, the Ruminant Feed Market must respond by developing innovative feed solutions that align with these values.

Economic Growth in Emerging Markets

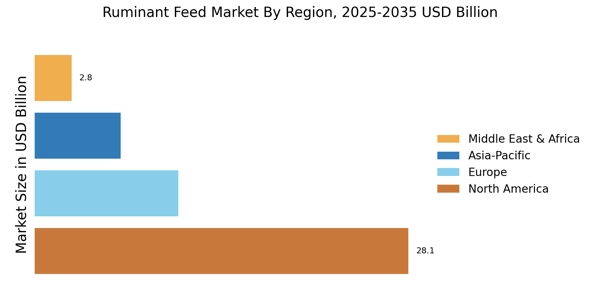

Economic growth in emerging markets is driving the expansion of the Ruminant Feed Market. As incomes rise, there is a notable shift in dietary patterns, with increased consumption of meat and dairy products. This trend is particularly pronounced in regions such as Asia and Africa, where urbanization and rising middle-class populations are fueling demand for livestock products. Recent projections indicate that the meat and dairy sectors in these regions could grow by over 5% annually in the coming years. Consequently, this economic growth necessitates a robust supply of ruminant feed to support livestock production. The Ruminant Feed Market must capitalize on these opportunities by ensuring that feed supply chains are efficient and capable of meeting the burgeoning demand.

Increasing Demand for Dairy Products

The rising demand for dairy products is a pivotal driver in the Ruminant Feed Market. As populations expand and dietary preferences shift towards protein-rich foods, the need for milk and dairy products surges. This trend is particularly evident in developing regions, where per capita consumption of dairy is on the rise. According to recent data, the dairy sector is projected to grow at a compound annual growth rate of approximately 3.5% over the next five years. Consequently, this escalating demand necessitates a corresponding increase in ruminant feed production, as livestock farmers seek to optimize milk yield and quality. The Ruminant Feed Market must adapt to these changing consumer preferences, ensuring that feed formulations meet the nutritional needs of dairy cattle while also addressing sustainability concerns.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable agricultural practices are increasingly influencing the Ruminant Feed Market. Governments are implementing policies aimed at reducing the environmental impact of livestock farming, which includes promoting the use of sustainable feed sources. For example, initiatives encouraging the incorporation of by-products and alternative protein sources into ruminant diets are gaining traction. This shift not only addresses sustainability concerns but also helps in managing feed costs, as these alternative sources can be more economical. The Ruminant Feed Market is thus positioned to benefit from these regulatory changes, as they encourage innovation and the development of more sustainable feed solutions. As regulations evolve, the industry must remain agile to adapt to these new standards while ensuring compliance.