Rugged Handheld Devices Market Summary

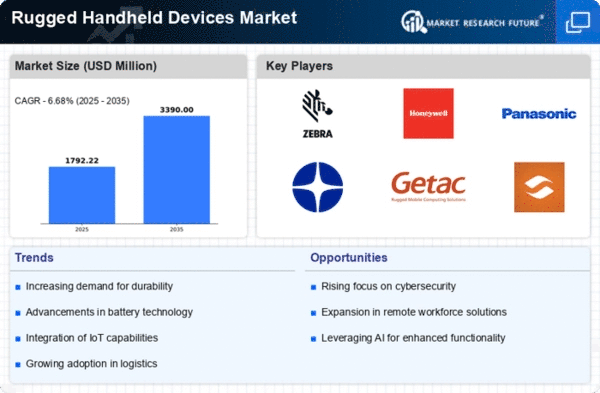

As per MRFR analysis, the Rugged Handheld Devices Market Size was estimated at 1680.0 USD Million in 2024. The Rugged Handheld Devices industry is projected to grow from 1770.0 in 2025 to 3390.0 by 2035, exhibiting a compound annual growth rate (CAGR) of 6.68 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Rugged Handheld Devices Market is experiencing robust growth driven by technological advancements and increasing demand across various sectors.

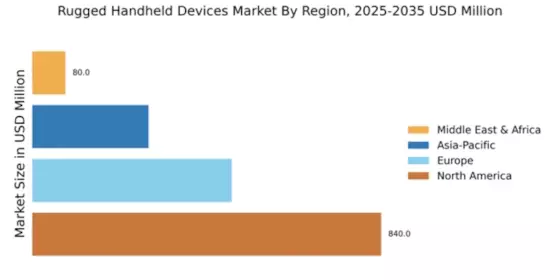

- The market is witnessing increased adoption in industrial sectors, particularly in North America, which remains the largest market.

- Technological advancements are enhancing the functionality and durability of rugged handheld devices, appealing to diverse applications.

- Field service continues to dominate the market, while healthcare emerges as the fastest-growing segment, reflecting evolving needs.

- Key market drivers include the growing emphasis on field mobility and the integration of advanced technologies to meet regulatory compliance.

Market Size & Forecast

| 2024 Market Size | 1680.0 (USD Million) |

| 2035 Market Size | 3390.0 (USD Million) |

| CAGR (2025 - 2035) | 6.68% |

Major Players

Zebra Technologies (US), Honeywell (US), Panasonic (JP), Datalogic (IT), Getac (TW), Juniper Systems (US), Sonim Technologies (US), Trimble (US), Motorola Solutions (US)