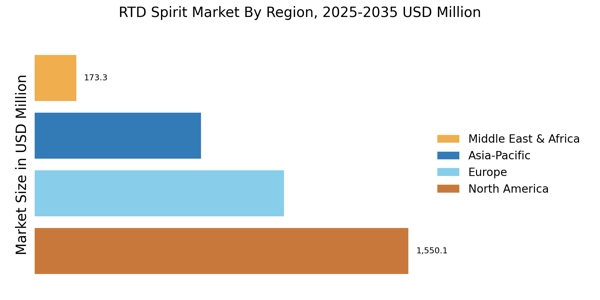

By Region, the study segments the market into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. North America RTD Spirit Market accounts for the largest market share 40.45% in 2022 and is expected to exhibit a 33.80% CAGR due to its robust cocktail culture and the quick implementation of convenience-oriented alcoholic beverages, particularly among younger customers. Europe accounts for the second largest market share in RTD Spirit Market. Which is driven by a rich tradition of alcohol consumption combined with a growing interest in ready-to-eat beverages with lower alcohol content.

The territory and strict focus on quality combined with a strong regulatory framework supporting the craft and premium segments will further strengthen its dominant position in the RTD spirit market. As a key player in the global RTD Spirit industry, North America has witnessed a surge in the production and consumption of RTD spirits. Further, US RTD Spirit Market held the largest market share, and the Canada RTD Spirit Market was the fastest-growing market in the North America region.

Further, the major countries studied are The U.S., Canada, Germany, France, Northern Africa, the UK, Italy, Spain, China, Japan, India, Australia & New Zealand, and Brazil.

Figure 3: RTD SPIRIT MARKET SHARE BY REGION 2022 (%)

The North America RTD Spirit Market stands as a dynamic and evolving sector, poised for continued expansion and revolution. This is because consumer tastes and lifestyles are changing. This changing environment is being shaped by several important trends. The growing focus on health and wellness is one of the most important trends in the RTD Spirits business in North America. People are becoming more health-conscious and looking for choices with less sugar, fewer calories, and natural ingredients. As a result, the number of "better-for-you" RTD Spirits being made and drunk is on the rise.

Brands are responding to health-conscious customers by making products with less sugar, organic ingredients, and clear nutritional information. The rise of homemade and artisanal RTD Spirits is another interesting trend. Consumers who know what they want are looking for unique choices that are made or sourced locally and show craftsmanship and authenticity. Craft distilleries are becoming more popular because they make RTD Spirits in small batches or by hand, giving them unique tastes and qualities that set them apart from mass-produced options.

This is part of a larger effort to support local businesses and appreciate the work that goes into high-quality goods. The North America RTD Spirit Market comprised of the US, Canada, & Mexico, among which the US emerged as the frontrunner with a market share of 73.26% in 2022.

The Asia-Pacific RTD Spirit Market is expected to grow at the highest CAGR of 38.12% from 2022 to 2032. The Asia-Pacific RTD (Ready-to-Drink) Spirits market is dynamic and changing quickly, driven by unique trends, drivers, and a lot of possibilities. People want more than just a drink; they want events that are immersive and memorable. Because of this trend, a lot of new RTD products have come out that aren't like standard cocktails. Brands are trying out things like interactive packaging, virtual reality labels, and partnerships with mixologists to make an experience that goes beyond just drinking the drink.

The trend of adding local flavors and ingredients to RTD Spirits shows how different Asia Pacific's food culture is. People are drawn to goods that taste real and show off the wide variety of flavors that are found in the area. Local herbs, spices, and veggies are being used by brands to make their products more appealing to local tastes. This trend fits with the growing pride in regional identity and the desire to help local communities.

People who care about their health are changing the market by choosing wellness-focused RTD Spirits. Products that have less alcohol, less sugar, and natural chemicals are becoming more popular. This trend reflects the global change towards more conscious consumption and the desire to live a healthy life without giving up taste and enjoyment. Sustainability is becoming an important part of the RTD Spirits business in Asia and the Pacific. Consumers are becoming more interested in brands that care about the environment by doing things like finding ingredients responsibly and using packaging that can be recycled.

The European RTD Spirit Market is changing quickly because customer tastes are changing, and new brands are becoming more popular. Several major trends are changing the way this market, which is always changing, looks. The growing focus on health and fitness is a major trend in the RTD Spirit Market in Europe. As people become more health-conscious, they want choices with less sugar, fewer calories, and more natural ingredients. Brands are quick to react with "better-for-you" RTD spirits, making products with less sugar, organic ingredients, and clear nutrition labels.

This trend shows that people want to enjoy themselves without putting their health at risk. Another interesting trend is that RTD Spirits are becoming more expensive. Europeans who know what they want are drawn to high-quality, handmade, and artisanal choices. Craft breweries are becoming more popular. They make RTD Spirits by hand in small batches with unique flavors and high quality. This is part of a larger movement towards appreciating the work that goes into high-quality goods and supporting local businesses, especially those with a strong regional impact.

The South American RTD Spirit Market is a fascinating mix of rich traditions, changing consumer tastes, and promising prospects. The praise of local flavors and ingredients is one of the most noticeable trends in the South American RTD Spirit Market. South America's varied and rich settings are home to many different herbs, fruits, and other plants. Brands are taking advantage of this abundance by giving their RTD goods a local feel. People like this trend because it gives them a taste of custom and lets them learn about the culinary history of the continent.

Craft and handmade RTD Spirits are becoming more and more appealing to people in South America. Small-batch, hand-made goods are becoming more popular because more people value quality and originality. Craft breweries are becoming more common. They make RTD Spirits with unique tastes and a strong sense of place.

The Middle East and Africa (MEA) region has witnessed a notable evolution in its RTD Spirit Market, which is a mix of old customs, new ideas, and unrealized promises, the key drivers, and the promising growth paths. The celebration of tradition and authenticity is one of the most important trends in the Middle East and Africa RTD Spirit Market. People in the area want to buy things that are in line with their culture and customs. As a result, brands are adding local flavors, spices, and ingredients to their RTD products to pay homage to the local food culture.

This trend draws people who want to feel like they're back in the past. The number of people in the Middle East and Africa who want luxury and craft RTD Spirits is growing. Consumers who know what they want are looking for small-batch, high-quality goods that show craftsmanship and attention to detail. Craft breweries are becoming more popular because they make RTD Spirits with unique flavors and a strong sense of place. This trend fits with the way people in the area value quality and like to use traditional ways to make things.