Rotating Machines For Biofuels Size

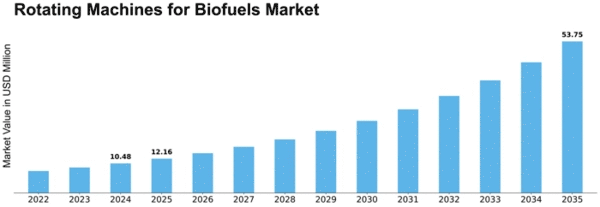

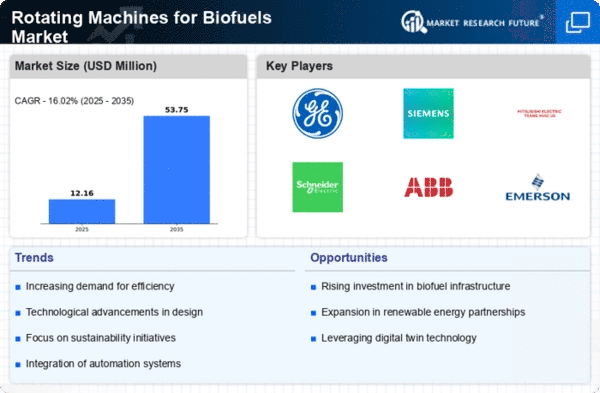

Rotating Machines for Biofuels Market Growth Projections and Opportunities

The anticipated surge in demand for energy derived from renewable sources is poised to stimulate the expansion of the worldwide market. The global landscape of rotating machines for biofuels is delineated by its categorization grounded on machine types and the methodologies employed in production.

In terms of machine types, this global market delineation encompasses compressors, fans, turbines, and gas heaters. In the year 2020, the compressors segment established dominance, claiming a substantial market share of 45.7%, amounting to a market value of USD 458.8. Projections indicate its potential to sustain a Compound Annual Growth Rate (CAGR) of 8.0% throughout the stipulated timeframe.

The segmentation based on production processes bifurcates the market into transesterification, gasification, fermentation, and other methods. Among these divisions, the transesterification segment seized the lion’s share in 2020, capturing 36.3% of the market and accruing a market value of 364.8. Forecasts indicate its potential to maintain a 7.72% CAGR over the anticipated duration.

The growing inclination toward renewable energy sources is the principal catalyst propelling the trajectory of the global rotating machines for biofuels market. This progression is meticulously demarcated by the types of machines utilized and the diverse processes applied in their production.

The segmentation premised on machine types incorporates a spectrum comprising compressors, fans, turbines, and gas heaters. In the calendar year 2020, the compressors segment ascended as the dominant force, commanding a significant market share of 45.7%, equivalent to a substantial market valuation of USD 458.8. Forecasts underpin its potential to sustain a remarkable Compound Annual Growth Rate (CAGR) of 8.0% across the envisaged timeline.

Parallelly, the classification grounded on production methodologies segregates the market into distinct categories encompassing transesterification, gasification, fermentation, and other procedural approaches. Within this framework, the transesterification segment emerged as the paramount contender in 2020, securing a market share of 36.3% and amassing a market worth of 364.8. Projections fortify the notion of its potential to perpetuate a robust 7.72% CAGR over the anticipated period.

Leave a Comment