Increasing Energy Demand

The Oil and Gas Static Rotating Equipment Market is experiencing a surge in demand due to the rising global energy requirements. As economies expand, the need for reliable energy sources intensifies, leading to increased investments in oil and gas exploration and production. This trend is particularly evident in emerging markets, where energy consumption is projected to grow significantly. According to recent estimates, the global energy demand is expected to rise by approximately 30 percent by 2040. Consequently, the Oil and Gas Static Rotating Equipment Market is poised to benefit from this heightened demand, as these systems are essential for efficient energy extraction and processing. The need for advanced rotating equipment that can operate under challenging conditions further underscores the market's growth potential.

Technological Advancements

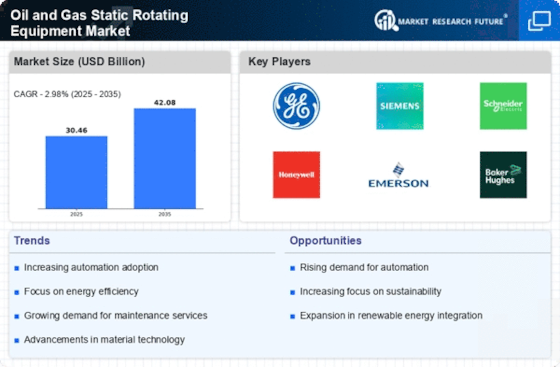

Technological innovations play a pivotal role in shaping the Oil and Gas Static Rotating Equipment Market. The advent of advanced materials, automation, and predictive maintenance technologies has enhanced the efficiency and reliability of rotating equipment. For instance, the integration of IoT and AI in monitoring systems allows for real-time data analysis, leading to improved operational performance. This technological evolution not only reduces downtime but also extends the lifespan of equipment, thereby lowering operational costs. As companies strive to optimize their processes, the demand for state-of-the-art static rotating equipment is likely to increase. The market is expected to witness a compound annual growth rate of around 5 percent over the next few years, driven by these technological advancements.

Focus on Operational Efficiency

In the Oil and Gas Static Rotating Equipment Market, there is a growing emphasis on operational efficiency. Companies are increasingly seeking ways to optimize their processes and reduce costs, which has led to a heightened demand for high-performance rotating equipment. Enhanced efficiency not only improves productivity but also minimizes energy consumption, aligning with sustainability goals. The implementation of advanced technologies, such as variable frequency drives and energy-efficient motors, is becoming commonplace as operators strive to achieve these objectives. This focus on efficiency is expected to propel the market forward, with projections indicating a steady increase in demand for static rotating equipment over the coming years. The potential for cost savings and improved performance makes this driver particularly compelling for industry stakeholders.

Investment in Renewable Energy Integration

The Oil and Gas Static Rotating Equipment Market is witnessing a shift as companies increasingly invest in renewable energy integration. As the energy landscape evolves, oil and gas operators are exploring ways to incorporate renewable sources into their operations. This trend necessitates the use of static rotating equipment that can efficiently handle diverse energy inputs. The integration of renewables not only enhances operational flexibility but also aligns with global sustainability initiatives. As investments in hybrid systems grow, the demand for adaptable rotating equipment is likely to rise. This shift presents a unique opportunity for manufacturers to innovate and develop equipment that meets the evolving needs of the industry. The potential for growth in this area suggests a dynamic future for the Oil and Gas Static Rotating Equipment Market.

Regulatory Compliance and Safety Standards

The Oil and Gas Static Rotating Equipment Market is significantly influenced by stringent regulatory frameworks and safety standards. Governments and regulatory bodies are increasingly emphasizing the need for safe and environmentally friendly operations in the oil and gas sector. Compliance with these regulations necessitates the adoption of high-quality rotating equipment that meets safety and performance criteria. This trend is particularly pronounced in regions with strict environmental laws, where companies are compelled to invest in advanced technologies to ensure compliance. As a result, the market for static rotating equipment is likely to expand as operators seek to enhance safety measures and reduce environmental impact. The financial implications of non-compliance further drive investments in reliable equipment, thereby bolstering market growth.

Leave a Comment