Focus on Cost Reduction

In the Rotary Steerable System Industry, there is a pronounced focus on cost reduction strategies among operators. Companies are increasingly seeking technologies that minimize drilling costs while maximizing output. Rotary steerable systems contribute to this objective by reducing the number of trips required during drilling, thereby saving time and resources. The potential for cost savings is substantial, as operators can achieve more efficient drilling operations with fewer resources. This emphasis on cost efficiency is likely to sustain the market's growth trajectory, particularly as operators strive to enhance their bottom lines.

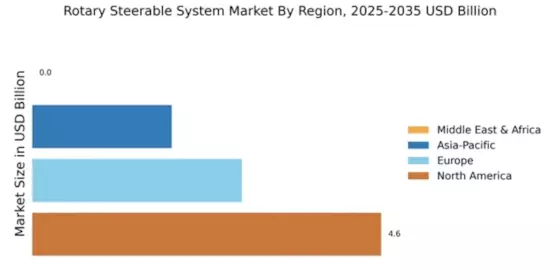

Market Growth Projections

The Global Rotary Steerable System Market is poised for substantial growth, with projections indicating a market value of 9.26 USD Billion in 2024 and an anticipated increase to 15.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.03% from 2025 to 2035. The increasing adoption of rotary steerable systems across various drilling applications, coupled with advancements in technology and rising demand for energy resources, is expected to drive this expansion. The market's robust growth reflects the industry's adaptability to changing energy landscapes and operational needs.

Technological Advancements

The Rotary Steerable System Market is experiencing rapid technological advancements, which enhance drilling efficiency and accuracy. Innovations such as improved sensor technologies and real-time data analytics are being integrated into rotary steerable systems, allowing for better decision-making during drilling operations. For instance, the implementation of advanced telemetry systems enables operators to monitor drilling parameters in real-time, leading to optimized performance. As a result, the market is projected to reach 9.26 USD Billion in 2024, reflecting the growing demand for sophisticated drilling solutions that improve operational efficiency.

Environmental Considerations

Environmental considerations are increasingly shaping the Rotary Steerable System Market. As stakeholders become more aware of the ecological impact of drilling activities, there is a growing demand for technologies that minimize environmental footprints. Rotary steerable systems, with their precision drilling capabilities, reduce the risk of surface contamination and improve resource recovery rates. This alignment with environmental sustainability is likely to attract investment and support from both public and private sectors, further propelling the market forward. The industry's commitment to sustainable practices may enhance its reputation and market viability.

Regulatory Support and Standards

The Rotary Steerable System Market benefits from regulatory support and established standards that promote safety and efficiency in drilling operations. Governments and industry associations are actively developing guidelines that encourage the adoption of advanced drilling technologies, including rotary steerable systems. Compliance with these regulations not only enhances operational safety but also fosters innovation within the industry. As regulatory frameworks evolve, they are expected to drive the adoption of rotary steerable systems, contributing to the market's anticipated growth rate of 5.03% from 2025 to 2035.

Increasing Demand for Oil and Gas

The Rotary Steerable System Market is significantly influenced by the increasing demand for oil and gas. As global energy consumption rises, particularly in emerging economies, the need for efficient drilling technologies becomes paramount. Rotary steerable systems facilitate the extraction of hydrocarbons from complex geological formations, thereby enhancing production rates. This trend is expected to drive the market's growth, with projections indicating a market value of 15.9 USD Billion by 2035. The industry's ability to adapt to evolving energy demands positions it favorably in the global energy landscape.