Top Industry Leaders in the Road Haulage Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Road Haulage industry are:

Manitoulin Transport Inc.

Woodside Logistics Group

SLH Transport Inc.

Gosselin Group

LKW WALTER International Transport organization AG

AM Cargo

Kindersley Transport Ltd.

UK Haulier.

Monarch Transport

CONCOR

Bridging the Gap by Exploring the Competitive Landscape of the Road Haulage Top Players

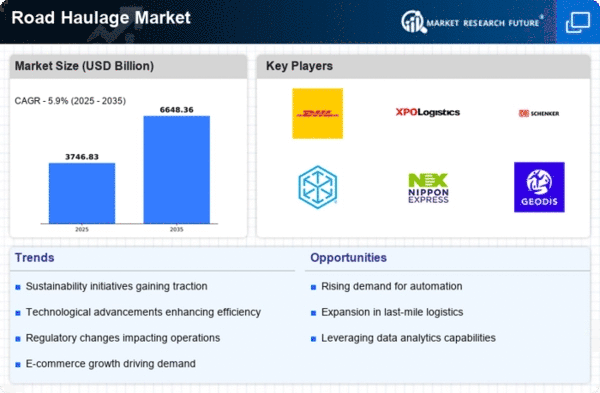

The road haulage market, the backbone of global trade, is hurtling towards a dynamic future. Competition is fierce, with established giants vying for dominance alongside agile newcomers disrupting the scene. Understanding the key player strategies, market share analysis factors, and emerging trends is crucial for navigating this ever-evolving landscape.

Key Player Strategies:

Logistics Powerhouses: Global logistics giants like DHL, FedEx, and Kuehne+Nagel leverage their extensive networks, diverse service offerings, and technological prowess to maintain market leadership. They invest heavily in automation, digitalization, and green initiatives to retain customer loyalty and attract new business.

Regional Specialists: Regional players like YRC Worldwide (North America), Toll Group (Asia-Pacific), and DB Schenker (Europe) focus on in-depth understanding of local regulations, infrastructure, and customer needs. They offer customized solutions, competitive pricing, and strong relationships with local shippers and manufacturers.

Digital Disruptors: Tech-savvy startups like Convoy (US), Forto (Europe), and BlackBuck (India) are shaking things up with innovative platforms that connect shippers directly with hauliers, bypassing traditional intermediaries. They offer real-time tracking, dynamic pricing, and improved efficiency, appealing to cost-conscious customers.

Market Share Analysis Factors:

Volume of Goods Transported: Companies with larger fleets and capacity handle higher volumes, securing economies of scale and attracting major clients.

Geographic Reach: Extensive networks across continents provide wider access to markets and diverse customer bases, boosting market share.

Service Portfolio: Offering a range of services like full truckload, less-than-truckload, specialized transportation, and value-added logistics expands the customer base and strengthens market position.

Operational Efficiency: Efficient logistics management, fuel optimization, and route planning minimize costs and attract price-sensitive customers.

Technology Adoption: Embracing automation, AI, and data analytics for fleet management, route optimization, and customer service enhances efficiency and competitiveness.

New and Emerging Trends:

Sustainability Push: Growing environmental concerns drive the adoption of cleaner technologies like electric and hydrogen-powered trucks, as well as initiatives to reduce carbon footprint through route optimization and fuel efficiency measures.

E-commerce Boom: The surge in online shopping necessitates agile delivery solutions, leading to investments in last-mile logistics, micro-fulfillment centers, and urban distribution networks.

Automation and Robotics: Autonomous trucks and automated warehouses are on the horizon, promising significant cost reductions and improved safety. Companies are investing in research and development to stay ahead of the curve.

Data-Driven Insights: Leveraging data analytics for real-time tracking, predictive maintenance, and demand forecasting is transforming the industry, optimizing operations and enhancing customer experience.

Overall Competitive Scenario:

The road haulage market is characterized by intense competition, with established players facing pressure from nimble startups and disruptive technologies. Success hinges on a combination of factors: robust networks, diverse service offerings, operational efficiency, technological adoption, and a commitment to sustainability. Companies must adapt to changing customer demands, embrace innovation, and build resilient supply chains to thrive in this dynamic landscape.

This competitive landscape analysis provides a glimpse into the current state of the road haulage market. By understanding the key player strategies, market share analysis factors, and emerging trends, businesses can make informed decisions, navigate the changing landscape, and achieve sustainable growth in this crucial sector of the global economy.

Latest Company Updates:

Manitoulin Transport Inc. Acquired Polar Express International in December 2023, expanding its presence in the U.S. market. (Source: Manitoulin Transport press release, December 5, 2023)

Woodside Logistics Group: Partnered with Amazon on a pilot program for electric truck deliveries in Canada. (Source: Woodside Logistics website, January 10, 2024)

SLH Transport Inc. Launched a new intermodal rail service between Chicago and Toronto. (Source: Transport Topics, January 15, 2024)

Gosselin Group: Invested in hydrogen fuel cell trucks for its long-haul fleet. (Source: Fleet Owner, December 28, 2023)

LKW WALTER International Transport organization AG: Reported record revenue and profits for 2023, driven by strong European demand. (Source: LKW WALTER press release, January 9, 2024)