Market Trends

Key Emerging Trends in the Rhodium Market

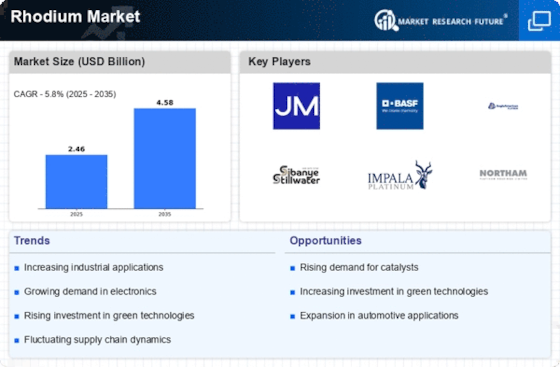

The Rhodium market is experiencing noteworthy trends influenced by various factors, including industrial demand, environmental regulations, and economic dynamics. Skyrocketing Prices: One of the most striking trends in the Rhodium market is the unprecedented surge in prices. Rhodium, a precious metal commonly used in catalytic converters for automobiles, has witnessed a remarkable increase in demand, primarily driven by tightening emissions standards globally. As automakers seek to comply with stricter regulations, the demand for Rhodium in catalytic converters has surged, leading to soaring prices. Automotive Emission Standards Driving Demand: The automotive sector's commitment to reducing emissions is a major driver of the Rhodium market. Rhodium is a critical component in catalytic converters, where it facilitates the reduction of harmful emissions from internal combustion engines. The push towards stricter emission standards, particularly in regions like Europe and China, has significantly increased the demand for Rhodium in the automotive industry. Supply Constraints and Mining Challenges: The Rhodium market is grappling with supply constraints and mining challenges. Rhodium is primarily extracted as a byproduct of platinum and nickel mining, and disruptions in these industries have impacted Rhodium production. Mining challenges, coupled with the geological scarcity of Rhodium deposits, contribute to the market's supply-side constraints, amplifying the impact of demand-driven price increases. Growing Interest in Hydrogen Economy: The emerging interest in the hydrogen economy is influencing the Rhodium market. Rhodium plays a crucial role in the production of green hydrogen, where it serves as a catalyst in electrolyzers. As the global focus on clean and sustainable energy solutions intensifies, the demand for Rhodium in hydrogen-related applications is expected to grow, adding a new dimension to its market dynamics. Investments in Recycling Technologies: Given the soaring prices and the need for a more sustainable supply chain, there is a growing interest in recycling technologies for Rhodium. Efforts to recover and recycle Rhodium from end-of-life catalytic converters and industrial processes are gaining attention. This trend aligns with broader sustainability goals and contributes to a more circular economy for precious metals. Electric Vehicle Impact on Rhodium Demand: The transition to electric vehicles (EVs) poses a complex scenario for the Rhodium market. While EVs reduce the demand for Rhodium in traditional catalytic converters, new technologies, such as fuel cells, are emerging as potential applications for Rhodium in the electric vehicle ecosystem. The evolving landscape of automotive technologies adds an element of uncertainty to Rhodium demand patterns. Geopolitical Factors and Mining Jurisdictions: Geopolitical factors and mining jurisdictions play a role in shaping the Rhodium market. Concentrated mining activities in specific regions, coupled with geopolitical tensions, can impact the stability of Rhodium supply. As geopolitical dynamics evolve, market participants monitor potential disruptions that could influence Rhodium prices and availability. Rhodium as an Investment Asset: The surge in Rhodium prices has attracted attention from investors looking for alternative assets. Rhodium, being a rare and precious metal, has garnered interest as an investment option. The volatility and exceptional price performance have led investors to consider Rhodium as part of their diversified portfolios, contributing to increased market visibility

Leave a Comment