Rhodium Size

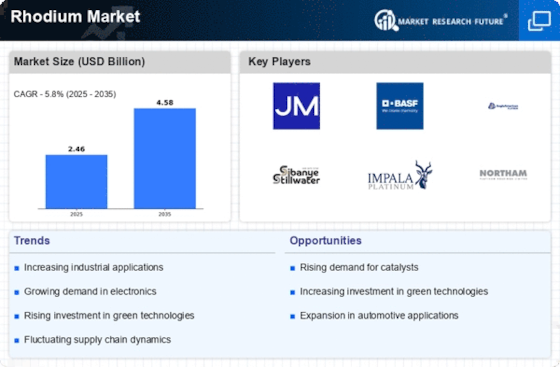

Rhodium Market Growth Projections and Opportunities

The Rhodium market is subject to various market factors that significantly influence its growth and dynamics. To gain insights into the dynamics of this precious metal market, it's essential to explore the critical market factors shaping the Rhodium industry. Here are key factors presented in a clear and concise pointer format: Automotive Catalyst Demand: A major driver for the Rhodium market is its use in automotive catalytic converters. Rhodium is a crucial component in catalytic converters for gasoline-powered vehicles, where it helps reduce harmful emissions. As global automotive production and environmental regulations increase, the demand for Rhodium in catalytic converters rises. Tight Supply-Demand Dynamics: Rhodium is characterized by limited global production, and its supply is primarily sourced as a byproduct of platinum and nickel mining. The tight supply-demand dynamics significantly impact Rhodium prices, making it sensitive to fluctuations in production, demand, and geopolitical factors. Emission Standards and Regulations: Stringent emission standards and environmental regulations worldwide drive the demand for Rhodium in automotive catalysts. As countries implement stricter emissions norms to address air quality concerns, the need for efficient catalytic converters containing Rhodium intensifies. Palladium and Platinum Substitution: Rhodium faces competition from other platinum group metals, particularly palladium and platinum, in catalytic applications. Shifts in market dynamics, driven by factors like relative pricing and availability of palladium and platinum, can influence the demand for Rhodium in catalytic converters. Jewelry and Investment Demand: Rhodium's application extends beyond catalytic converters to the jewelry industry, where it is used for plating and alloying. Additionally, some investors view Rhodium as a store of value and diversification asset, contributing to its demand in the investment market. Geopolitical and Mining Factors: Geopolitical events, mining disruptions, and changes in mining policies can impact Rhodium production. Concentrated mining activities in a few countries, particularly South Africa, which accounts for a significant share of global Rhodium production, make the market susceptible to geopolitical and mining-related disruptions. Global Economic Trends: Economic conditions and industrial activities influence the demand for Rhodium, especially in manufacturing and automotive sectors. Economic downturns can lead to reduced demand for automobiles, affecting Rhodium consumption in catalytic converters and, consequently, its market dynamics. Research and Technological Developments: Ongoing research and technological developments in automotive and catalyst technologies can influence the demand for Rhodium. Innovations in catalyst design and materials may impact the type and amount of Rhodium required in future automotive applications. Electric Vehicle Adoption: The growing adoption of electric vehicles (EVs) poses a potential challenge to Rhodium demand. As the automotive industry shifts toward electric mobility, the use of traditional catalytic converters may decline, affecting Rhodium consumption in this specific application. Market Speculation and Investment Trends: Rhodium prices can be influenced by market speculation and investment trends. Given its relatively small market size, Rhodium is susceptible to price volatility driven by speculative trading, investment fund activity, and shifts in investor sentiment.

Leave a Comment