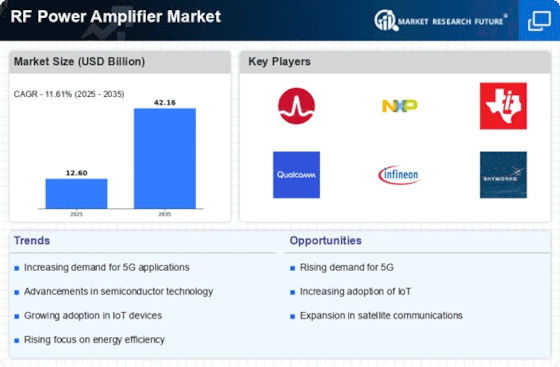

Leading market players are investing heavily in research and development to expand their product lines, which will help the RF power amplifier market grow even more. There are some strategies for action that market participants are implementing to increase their presence around the world's global footprint, with important market developments including new product launches, contractual agreements and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the RF power amplifier industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer use in the global RF power amplifier industry to benefit clients and increase the market sector. In recent years, the RF power amplifier industry has offered some of the most significant technological advancements. Major players in the RF power amplifier market, including Analog Devices Inc., Broadcom Ltd., II-VI Inc., Infineon Technologies AG, Mitsubishi Corporation, Murata Manufacturing Co. Ltd., NXP Semiconductors NV, Qualcomm Inc., Skyworks Solutions Inc., Toshiba Corporation, and others are attempting to grow market demand by investing in research and development operations.

Semiconductors are crucial for the current energy crisis and the digital transition. Because of this, Infineon is committed to leading the transition to digital and low-carbon technology. As a premier semiconductor firm in the world, we enable game-changing solutions for clean and efficient energy, clean and safe mobility, and a smart and secure Internet of Things. We make life better by making it easier, safer, and less harmful to the environment by working together with our customers. Infineon is a thriving worldwide corporation with a unique workforce thanks to its employees' knowledge, enthusiasm, and courage from more than 90 countries.

Since the semiconductor's discovery, we've made daily progress toward the future.

In March Infineon Technologies AG and GaN Systems said they had signed a final deal allowing Infineon to buy GaN Systems for $830 million. GaN Systems is a world leader in technology-making power conversion systems based on GaN.

Analog Devices is a world leader in semiconductors. It connects the digital and physical worlds to make breakthroughs at the Intelligent Edge. ADI combines analog, digital, and software technologies to make solutions that help improve digital factories, mobility, and digital healthcare, fight climate change, and connect people to the rest of the world in a reliable way.

In June it was announced that ADI's MEMS sensor technology would be used in Envision Energy's next generation of intelligent wind turbines. Envision Energy is a division of Envision Group that provides cutting-edge green technologies.

Improved real-time monitoring of vibration, tilt, and other information that might advise safer windmill operation and design is one of the initial goals of the partnership. Incorporating the cutting-edge features of MEMS sensors into real-time monitoring infrastructure is a step forward in the green energy revolution.