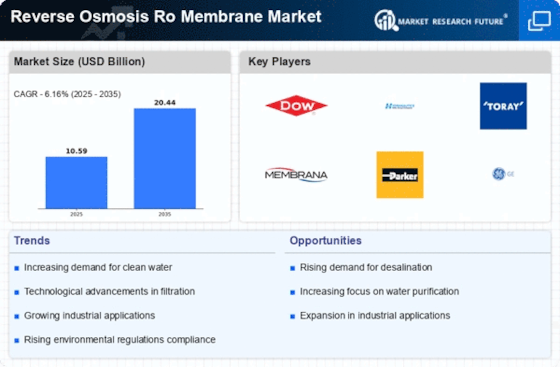

Increasing Water Scarcity

The escalating issue of water scarcity is a primary driver for the Reverse Osmosis Ro Membrane Market. As populations grow and industrial activities expand, the demand for clean water intensifies. Reports indicate that by 2025, nearly 1.8 billion people may live in areas with absolute water scarcity. This situation compels municipalities and industries to invest in advanced water purification technologies, including reverse osmosis systems. The Reverse Osmosis Ro Membrane Market is poised to benefit from this trend, as these membranes are essential for effective desalination and wastewater treatment processes. Furthermore, the increasing awareness of water conservation practices among consumers and businesses further propels the demand for efficient water purification solutions, thereby enhancing the market's growth prospects.

Rising Industrial Applications

The expanding industrial sector is a crucial driver for the Reverse Osmosis Ro Membrane Market. Industries such as food and beverage, pharmaceuticals, and electronics require high-quality water for their operations. The need for consistent and reliable water purification solutions is paramount, as impurities can adversely affect product quality and operational efficiency. Market analysis indicates that the food and beverage industry alone accounts for a significant share of the reverse osmosis market, driven by the need for water that meets stringent quality standards. As industries increasingly adopt reverse osmosis systems to ensure compliance and enhance production processes, the demand for RO membranes is expected to surge. This trend underscores the pivotal role of the Reverse Osmosis Ro Membrane Market in supporting industrial growth and sustainability.

Technological Innovations in Membrane Design

Technological advancements in membrane design are transforming the Reverse Osmosis Ro Membrane Market. Innovations such as the development of thin-film composite membranes and improved membrane materials enhance the efficiency and lifespan of reverse osmosis systems. These advancements not only reduce operational costs but also improve the overall performance of water purification processes. Market data suggests that the introduction of high-flux membranes could increase water recovery rates by up to 30%, making them highly attractive for various applications. As industries seek to optimize their water treatment processes, the demand for advanced membrane technologies is likely to rise. Consequently, the Reverse Osmosis Ro Membrane Market stands to gain from these innovations, as they enable more effective and sustainable water purification solutions.

Consumer Awareness and Demand for Clean Water

Growing consumer awareness regarding health and environmental issues is driving the Reverse Osmosis Ro Membrane Market. As individuals become more conscious of the quality of their drinking water, the demand for effective purification systems rises. Consumers are increasingly seeking solutions that not only provide clean water but also eliminate harmful contaminants. This shift in consumer behavior is prompting manufacturers to innovate and offer advanced reverse osmosis systems that cater to these needs. Market data suggests that residential applications for reverse osmosis systems are on the rise, reflecting a broader trend towards home water purification. As a result, the Reverse Osmosis Ro Membrane Market is likely to experience sustained growth, fueled by the increasing demand for safe and clean drinking water among consumers.

Regulatory Support for Water Quality Standards

Regulatory frameworks aimed at improving water quality are significantly influencing the Reverse Osmosis Ro Membrane Market. Governments worldwide are implementing stringent regulations to ensure safe drinking water and protect public health. For instance, the establishment of maximum contaminant levels for various pollutants necessitates the adoption of advanced filtration technologies, including reverse osmosis. This regulatory push is expected to drive the market, as industries and municipalities seek compliance with these standards. The Reverse Osmosis Ro Membrane Market is likely to see increased investments in membrane technology to meet these regulatory requirements, thereby fostering innovation and enhancing product offerings. As a result, the market may experience robust growth, driven by the need for compliance and the pursuit of higher water quality.