Government Support and Investment

The Reusable Satellite Launch Vehicle Market (RSLV) Market benefits significantly from government support and investment initiatives. Various nations are recognizing the strategic importance of space capabilities and are investing in RSLV technologies to enhance their national security and economic competitiveness. For instance, government funding for space programs has seen a marked increase, with some countries allocating billions to develop indigenous RSLV capabilities. This financial backing not only accelerates technological advancements but also encourages private sector collaboration, thereby fostering innovation within the RSLV market. As governments continue to prioritize space exploration and satellite deployment, the RSLV market is poised for substantial growth.

Increased Focus on Sustainability

The Reusable Satellite Launch Vehicle Market (RSLV) Market is increasingly aligning with sustainability goals as environmental concerns gain prominence. The shift towards reusable launch systems is seen as a crucial step in reducing the carbon footprint associated with space launches. RSLVs are designed to minimize waste and optimize resource utilization, which resonates with global sustainability initiatives. Market participants are actively exploring eco-friendly propulsion systems and practices to further enhance their environmental credentials. This focus on sustainability is likely to attract environmentally conscious investors and customers, thereby expanding the RSLV market as it aligns with broader efforts to promote sustainable practices in the aerospace sector.

Cost Efficiency in Launch Operations

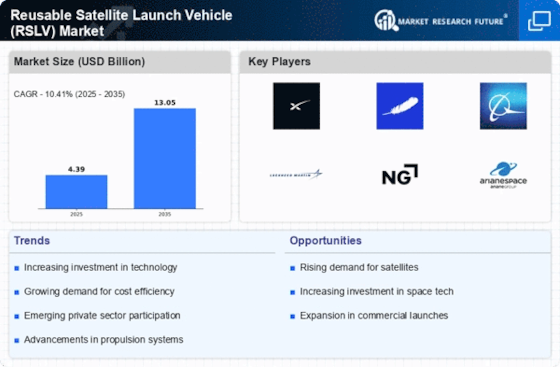

The Reusable Satellite Launch Vehicle Market (RSLV) Market is experiencing a notable shift towards cost efficiency. The ability to reuse launch vehicles significantly reduces the cost per launch, which is a critical factor for both governmental and commercial entities. Reports indicate that reusability can lower launch costs by up to 30%, making space access more affordable. This economic advantage is particularly appealing to small satellite operators and emerging space companies, who are increasingly entering the market. As the demand for satellite deployment rises, the emphasis on cost-effective solutions is likely to drive the RSLV market forward, fostering a competitive landscape where affordability becomes a key differentiator.

Growing Demand for Satellite Services

The Reusable Satellite Launch Vehicle Market (RSLV) Market is propelled by the escalating demand for satellite services across various sectors. With the proliferation of satellite applications in telecommunications, Earth observation, and global internet coverage, the need for reliable and frequent launches is paramount. Market data suggests that the satellite services sector is projected to grow at a compound annual growth rate of approximately 5% over the next decade. This growth necessitates a robust launch infrastructure, where RSLVs play a pivotal role in meeting the increasing launch frequency and payload capacity requirements. Consequently, the RSLV market is likely to expand in response to this burgeoning demand.

Technological Innovations in Launch Systems

The Reusable Satellite Launch Vehicle Market (RSLV) Market is characterized by rapid technological innovations that enhance launch systems' efficiency and reliability. Advancements in materials science, propulsion technologies, and autonomous flight systems are transforming the capabilities of RSLVs. For example, the integration of advanced composite materials has improved vehicle durability while reducing weight, which is crucial for maximizing payload capacity. Furthermore, innovations in reusable rocket engines are enabling multiple flights with minimal refurbishment. These technological strides not only improve operational efficiency but also attract investment and interest from various stakeholders, thereby propelling the RSLV market forward.