Retail Ready Packaging Size

Market Size Snapshot

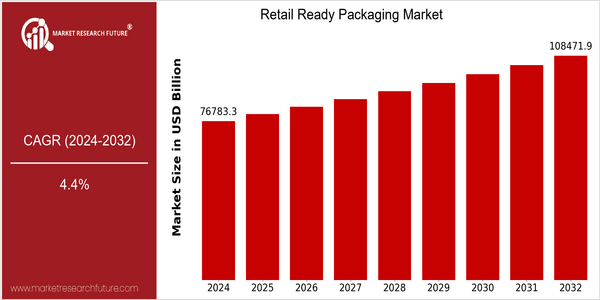

| Year | Value |

|---|---|

| 2024 | USD 76783.3 Billion |

| 2032 | USD 108471.92 Billion |

| CAGR (2024-2032) | 4.4 % |

Note – Market size depicts the revenue generated over the financial year

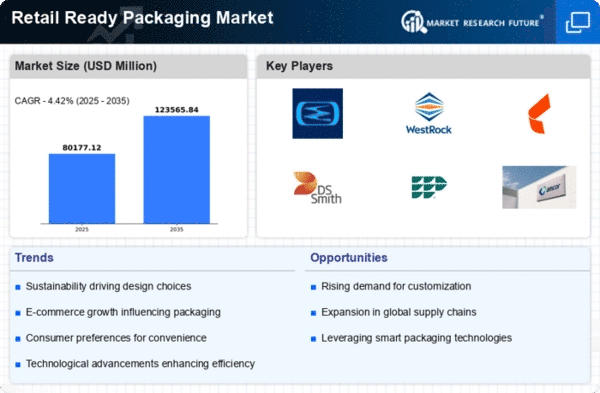

Retail Ready Packages (RRP) Market to Grow Significantly in the Future The Retail Ready Packages (RRP) Market is estimated to reach a market size of USD 76,783,302,000 by 2024, and is expected to reach a market size of USD 108,471,923,000 by 2032. This will represent a CAGR of 4.4% during the forecast period from 2024 to 2032. The increasing demand for efficient and sustainable packaging solutions, combined with the growing trend of e-commerce and retail modernization, is driving this market growth. The increasing concern for the environment among consumers is also driving the demand for sustainable and biodegradable packaging materials. The major players in the industry, such as Smurfit Kappa, Westrock, and Mondi Group, are investing in the development of new packaging solutions and establishing strategic alliances to enhance their product offerings. For example, the development of smart packaging solutions that can optimize supply chain efficiency and enhance customer engagement shows that the market is developing dynamically.

Regional Market Size

Regional Deep Dive

The market for retail-ready packaging is growing in various regions. The increasing demand for sustainable and efficient packaging solutions is driving the growth. In North America, the market is characterized by a strong focus on innovation and sustainable solutions, with the aim of reducing waste and improving the customer experience. In Europe, the market is diversified and regulated by strict rules for eco-friendly packaging. In Asia-Pacific, the market is growing rapidly because of the booming e-commerce industry. The Middle East and Africa are gradually adopting modern retail formats, while Latin America is using local materials to create cost-effective packaging solutions. Each region has its own trends and opportunities.

Europe

- The European Union's stringent regulations on single-use plastics are driving the adoption of recyclable and reusable retail ready packaging, prompting companies like Unilever and Nestlé to innovate their packaging strategies.

- There is a growing trend towards digital printing technologies in RRP, allowing for customized packaging solutions that cater to local markets, as seen with companies like Smurfit Kappa.

Asia Pacific

- The rapid growth of the retail sector in countries like China and India is propelling the demand for retail ready packaging, with local companies such as Huhtamaki and Amcor expanding their production capabilities.

- Innovations in smart packaging technologies, including QR codes and NFC tags, are being integrated into retail ready packaging to enhance consumer engagement and provide product information.

Latin America

- Local manufacturers are increasingly utilizing sustainable materials for retail ready packaging, with companies like Grupo Gondi leading the way in eco-friendly packaging solutions.

- The growth of the informal retail sector in Latin America is prompting innovations in RRP to cater to small retailers, enhancing product visibility and accessibility.

North America

- The rise of e-commerce has led to an increased demand for Retail Ready Packaging (RRP) solutions, with companies like Amazon and Walmart investing heavily in packaging innovations to enhance supply chain efficiency.

- Sustainability initiatives are gaining traction, with organizations such as the Sustainable Packaging Coalition advocating for eco-friendly materials and practices, influencing manufacturers to adopt greener packaging solutions.

Middle East And Africa

- The shift towards modern retail formats in the Middle East is driving demand for retail ready packaging, with companies like Al Ain Farms investing in RRP to improve shelf visibility and consumer appeal.

- Government initiatives aimed at reducing plastic waste are encouraging manufacturers to explore biodegradable and sustainable packaging options, influencing market dynamics in the region.

Did You Know?

“Retail Ready Packaging can reduce the time it takes to stock shelves by up to 50%, significantly improving operational efficiency for retailers.” — Packaging World

Segmental Market Size

Retail Ready Packages play an important role in enhancing the visibility of products on the shelves, and in facilitating the efficient management of the supply chain. This segment is currently growing, in response to increasing consumer demand for convenience and for more sustainable products. The rise of e-commerce, which requires the easy display and handling of products, and the development of public policies favouring the use of sustainable materials are two of the main factors behind this demand. Retail Ready Packages are therefore a major concern for the major consumer goods companies, such as Unilever and Procter & Gamble. The implementation of Retail Ready Packages has now reached a mature stage, with notable developments in many regions, particularly in North America and Europe. The major retailers such as Walmart and Tesco have used them to optimize their operations and to increase the visibility of their products on the shelves. The main applications are for food and drink, where they extend the shelf life of products and reduce food waste. Also driving the market are the increasing requirements for sustainable products and the use of fewer plastics. Recent developments in digital printing and in the field of smart packaging are shaping the evolution of the industry, enabling the creation of more engaging and informative packages.

Future Outlook

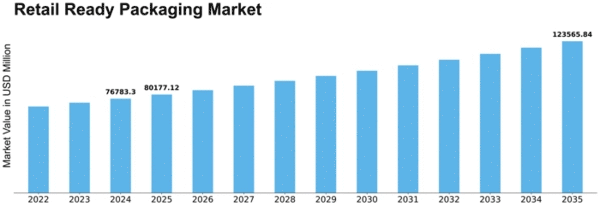

Retail Ready Packages will grow from approximately $76.78 billion in 2024 to $107.47 billion in 2032, with a compound annual growth rate (CAGR) of 4.6%. The growth is mainly driven by the growing demand for sustainable and efficient packaging solutions that increase product visibility and reduce waste. Retailers and manufacturers are increasingly focusing on the use of sustainable materials and designs in Retail Ready Packages. By 2032, it is estimated that over 60% of Retail Ready Packages will contain biodegradable or recyclable materials, which will meet the requirements of the UN’s sustainable development goals and the growing demand from consumers for sustainable products. Also, technological advancements, such as smart packaging and automation of packaging processes, are expected to drive the market’s expansion. In addition, digital printing and labeling technology will enable brands to create more engaging and informative packages, which will enhance the customer experience at the point of purchase. Regulations aimed at reducing plastic waste and promoting circular economy practices will also stimulate the shift towards Retail Ready Packages. This will result in a greater penetration of Retail Ready Packages across various industries, such as food and beverage, personal care, and consumer electronics.

Leave a Comment