Growing Aging Population

The demographic shift towards an aging population is significantly influencing the Respiratory Care Devices Market. Older adults are more susceptible to respiratory conditions, necessitating the use of various respiratory care devices. As the global population aged 65 and above continues to rise, the demand for effective respiratory management solutions is expected to increase correspondingly. This demographic trend is prompting healthcare systems to allocate more resources towards respiratory care, thereby driving market growth. It is estimated that by 2030, the number of older adults will reach approximately 1.4 billion, further amplifying the need for specialized respiratory care devices. Consequently, manufacturers are focusing on developing user-friendly and efficient devices tailored to the needs of this demographic.

Rising Prevalence of Respiratory Diseases

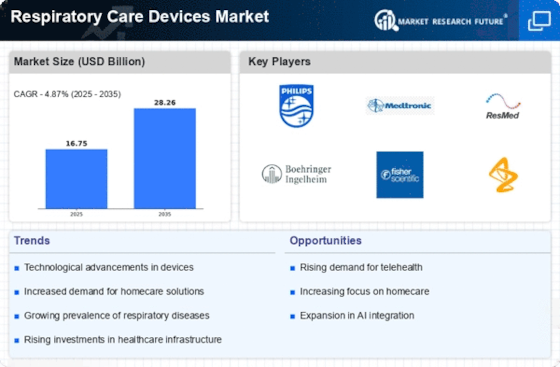

The increasing incidence of respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD), is a primary driver of the Respiratory Care Devices Market. According to recent estimates, millions of individuals are affected by these conditions, leading to a heightened demand for effective management solutions. This trend is further exacerbated by environmental factors, including air pollution and allergens, which contribute to the worsening of respiratory health. As a result, healthcare providers are increasingly investing in advanced respiratory care devices to enhance patient outcomes. The market for these devices is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 8% over the next several years, reflecting the urgent need for innovative solutions in respiratory care.

Technological Innovations in Device Design

Technological advancements play a crucial role in shaping the Respiratory Care Devices Market. Innovations such as portable nebulizers, smart inhalers, and advanced ventilators are transforming the landscape of respiratory care. These devices are designed to improve patient compliance and enhance treatment efficacy. For instance, the integration of digital health technologies allows for real-time monitoring and data collection, enabling healthcare providers to tailor treatments to individual patient needs. The market is witnessing a surge in demand for these technologically advanced devices, with projections indicating a substantial increase in market value over the coming years. This trend underscores the importance of continuous innovation in meeting the evolving needs of patients and healthcare systems.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a pivotal factor propelling the Respiratory Care Devices Market. Governments and private entities are increasingly recognizing the importance of robust healthcare systems, particularly in the realm of respiratory care. Enhanced funding is being directed towards the development of hospitals, clinics, and specialized care facilities equipped with advanced respiratory devices. This trend is likely to facilitate better access to respiratory care services, ultimately improving patient outcomes. Furthermore, the expansion of healthcare facilities is expected to create a favorable environment for the adoption of innovative respiratory care technologies. As a result, the market is poised for growth, with an anticipated increase in the availability and accessibility of respiratory care devices.

Rising Awareness and Education on Respiratory Health

There is a growing awareness and education regarding respiratory health, which is significantly impacting the Respiratory Care Devices Market. Public health campaigns and educational initiatives are increasingly focusing on the importance of respiratory health, leading to greater recognition of respiratory diseases and their management. This heightened awareness is driving demand for respiratory care devices, as individuals seek effective solutions for prevention and treatment. Additionally, healthcare professionals are being trained to better understand and address respiratory conditions, further contributing to the market's growth. The emphasis on respiratory health education is expected to continue, fostering a culture of proactive health management and increasing the utilization of respiratory care devices.