Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the Resource Circulation Equipment Market. Various countries are implementing policies and providing funding to promote sustainable waste management practices. For example, grants and subsidies for recycling infrastructure development are becoming more common, encouraging businesses to invest in resource circulation equipment. In 2025, it is anticipated that government funding for waste management projects will exceed 10 billion USD, reflecting a commitment to enhancing recycling capabilities. These initiatives not only support the growth of the Resource Circulation Equipment Market but also foster collaboration between public and private sectors, driving innovation and efficiency in resource management.

Circular Economy Adoption by Industries

The adoption of circular economy principles across various industries is a key driver for the Resource Circulation Equipment Market. As businesses recognize the economic and environmental benefits of resource efficiency, there is a growing trend towards implementing circular practices. Industries such as manufacturing, construction, and retail are increasingly focusing on reducing waste and maximizing resource recovery. Reports suggest that the circular economy could generate over 4.5 trillion USD in economic benefits by 2030, highlighting its potential impact. This shift not only enhances sustainability but also creates new business opportunities within the Resource Circulation Equipment Market, as companies seek innovative solutions to optimize their resource use and minimize waste.

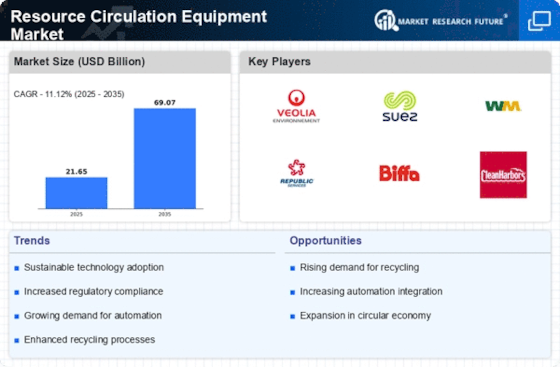

Increased Demand for Recycling Solutions

The Resource Circulation Equipment Market is experiencing heightened demand for recycling solutions, driven by a growing awareness of environmental sustainability. As industries and consumers alike prioritize waste reduction, the need for efficient recycling equipment becomes paramount. In 2025, the market for recycling equipment is projected to reach approximately 30 billion USD, reflecting a compound annual growth rate of around 5%. This trend indicates a shift towards circular economy practices, where resources are reused and recycled, thereby minimizing waste. Companies are increasingly investing in advanced recycling technologies to enhance their operational efficiency and reduce their carbon footprint. This demand for innovative recycling solutions is likely to propel the Resource Circulation Equipment Market forward, as stakeholders seek to align with sustainability goals and regulatory requirements.

Rising Consumer Awareness and Participation

Consumer awareness regarding environmental issues is on the rise, significantly impacting the Resource Circulation Equipment Market. As individuals become more conscious of their ecological footprint, there is an increasing demand for products and services that promote sustainability. This shift in consumer behavior is prompting businesses to adopt more responsible practices, including investing in resource circulation equipment. Surveys indicate that over 70% of consumers are willing to pay a premium for sustainable products, which is likely to drive market growth. Companies that align their operations with consumer expectations are better positioned to thrive in the evolving landscape of the Resource Circulation Equipment Market, as they cater to a more environmentally conscious clientele.

Technological Innovations in Resource Management

Technological advancements are significantly influencing the Resource Circulation Equipment Market. Innovations such as automation, artificial intelligence, and IoT integration are enhancing the efficiency of resource management systems. For instance, smart sorting technologies are being developed to improve the accuracy of waste separation, which is crucial for effective recycling processes. The market for smart waste management solutions is expected to grow substantially, with estimates suggesting a value of over 15 billion USD by 2026. These technologies not only streamline operations but also provide valuable data analytics that can inform better decision-making. As organizations increasingly adopt these technologies, the Resource Circulation Equipment Market is likely to witness a transformation, characterized by improved resource utilization and reduced operational costs.