Rise of Digital Marketing Channels

The proliferation of digital marketing channels is a pivotal driver in the Marketing Resource Management Market. With the advent of social media, email marketing, and online advertising, businesses are compelled to adapt their strategies to leverage these platforms effectively. Data indicates that digital marketing expenditures are projected to reach over 500 billion dollars by 2025, underscoring the importance of resource management in navigating this landscape. Companies are increasingly investing in tools that facilitate the management of these diverse channels, ensuring that marketing efforts are cohesive and targeted. This trend is likely to continue shaping the Marketing Resource Management Market as organizations seek to harness the full potential of digital marketing.

Focus on Customer Experience Enhancement

Enhancing customer experience is a critical driver in the Marketing Resource Management Market. Organizations are increasingly prioritizing customer-centric strategies to foster loyalty and engagement. This focus on customer experience necessitates effective resource management to ensure that marketing efforts resonate with target audiences. Companies are investing in tools that allow for personalized marketing, enabling them to tailor messages and offers to individual preferences. Data suggests that businesses that prioritize customer experience can see a 25% increase in customer retention rates. As the competition intensifies, the emphasis on customer experience is likely to remain a key factor influencing the Marketing Resource Management Market.

Emphasis on Collaboration and Integration

Collaboration and integration among marketing teams are essential drivers in the Marketing Resource Management Market. As organizations strive for cohesive marketing strategies, the need for tools that facilitate collaboration becomes paramount. Integrated marketing resource management solutions enable teams to work together seamlessly, sharing insights and resources effectively. This trend is particularly relevant as companies expand their marketing efforts across multiple channels and platforms. The ability to collaborate efficiently can lead to improved campaign outcomes and a more unified brand message. As such, the demand for integrated solutions is likely to grow, further propelling the Marketing Resource Management Market.

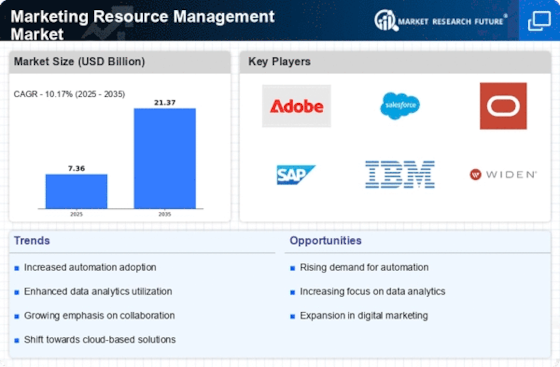

Increased Demand for Marketing Efficiency

The Marketing Resource Management Market is experiencing a surge in demand for enhanced marketing efficiency. Organizations are increasingly recognizing the need to optimize their marketing processes to achieve better results with limited resources. This trend is driven by the necessity to streamline operations, reduce costs, and improve return on investment. According to recent data, companies that implement effective marketing resource management strategies can see a 20% increase in marketing efficiency. As businesses strive to remain competitive, the focus on maximizing the impact of marketing budgets is likely to propel the growth of the Marketing Resource Management Market.

Growing Importance of Data-Driven Decision Making

In the Marketing Resource Management Market, the emphasis on data-driven decision making is becoming increasingly pronounced. Organizations are leveraging analytics to inform their marketing strategies, enabling them to make more informed choices regarding resource allocation and campaign effectiveness. The ability to analyze consumer behavior and market trends allows businesses to tailor their marketing efforts more precisely. Recent studies suggest that companies utilizing data analytics in their marketing strategies can achieve up to a 30% increase in campaign performance. This growing reliance on data is likely to drive the demand for sophisticated marketing resource management solutions that can integrate and analyze vast amounts of information.