Economic Viability

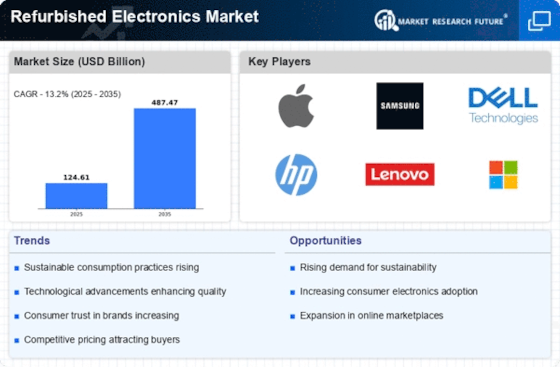

Economic factors play a crucial role in shaping the Refurbished Electronics Market. With the rising cost of new electronic devices, consumers are increasingly seeking cost-effective alternatives. Refurbished electronics often provide a viable solution, offering significant savings compared to brand-new products. Data suggests that the refurbished market is projected to grow at a compound annual growth rate of over 10% in the coming years, driven by this economic rationale. Additionally, businesses are recognizing the potential for profit in the refurbishment process, leading to an increase in the number of companies entering this market. This economic viability not only attracts budget-conscious consumers but also encourages manufacturers to invest in refurbishment programs, thereby expanding the overall market landscape.

Sustainability Awareness

The increasing awareness of sustainability among consumers appears to be a pivotal driver for the Refurbished Electronics Market. As environmental concerns gain traction, individuals are more inclined to opt for refurbished products, which contribute to reducing electronic waste. Reports indicate that the electronics sector is responsible for a substantial portion of global waste, with millions of tons discarded annually. By choosing refurbished electronics, consumers not only save money but also participate in a more sustainable consumption model. This shift in consumer behavior is likely to bolster the demand for refurbished products, as companies align their offerings with eco-friendly practices. The Refurbished Electronics Market is thus positioned to benefit from this growing trend, as businesses increasingly emphasize their commitment to sustainability in marketing strategies.

Technological Advancements

Technological advancements are significantly influencing the Refurbished Electronics Market. As technology evolves, the lifecycle of electronic devices shortens, leading to a higher volume of products entering the refurbishment cycle. Innovations in refurbishment processes, such as automated testing and quality assurance, enhance the reliability of refurbished products, making them more appealing to consumers. Furthermore, the integration of advanced technologies in refurbished devices, such as improved software and hardware capabilities, ensures that these products remain competitive with new models. This trend suggests that the Refurbished Electronics Market is not merely a secondary market but a dynamic sector that adapts to technological changes, potentially attracting a broader customer base.

Regulatory Support and Incentives

Regulatory support and incentives are emerging as influential drivers in the Refurbished Electronics Market. Governments are increasingly recognizing the importance of promoting sustainable practices, leading to policies that encourage the refurbishment and resale of electronics. Incentives such as tax breaks for refurbishment companies and programs aimed at educating consumers about the benefits of refurbished products are becoming more common. This regulatory environment is likely to stimulate growth in the refurbished sector, as businesses are motivated to comply with sustainability goals. Furthermore, as regulations evolve, the Refurbished Electronics Market may see enhanced legitimacy and consumer confidence, paving the way for broader acceptance and market expansion.

Consumer Trust and Quality Assurance

Consumer trust is paramount in the Refurbished Electronics Market, and improvements in quality assurance are fostering this trust. As more companies implement rigorous testing and certification processes, the perception of refurbished products is shifting positively. Data indicates that a significant percentage of consumers are now willing to purchase refurbished electronics, provided they come with warranties and guarantees. This shift is likely to enhance the overall market, as consumers feel more secure in their purchases. Additionally, brands that prioritize quality assurance are likely to see increased loyalty and repeat business, further solidifying their position in the Refurbished Electronics Market. The emphasis on quality not only benefits consumers but also elevates the standards across the industry.