Cost Efficiency

The rising cost of new computers and laptops drives consumers towards the refurbished computers and laptops market. As individuals and businesses seek to optimize their budgets, refurbished devices present a financially viable alternative. According to recent data, the average price of a new laptop has increased by approximately 15% over the past two years, making refurbished options increasingly attractive. This trend is particularly evident among small to medium-sized enterprises that prioritize cost savings without compromising on quality. The refurbished computers and laptops market thus benefits from this shift, as consumers recognize the value in purchasing high-quality, pre-owned devices at a fraction of the cost of new ones.

Corporate Adoption

The growing trend of corporate adoption of refurbished devices significantly impacts the refurbished computers and laptops market. Many organizations are recognizing the benefits of integrating refurbished technology into their operations, particularly in terms of cost savings and sustainability. Companies are increasingly opting for refurbished computers and laptops to equip their employees, as this approach allows them to allocate resources more efficiently. Recent surveys indicate that approximately 40% of businesses have incorporated refurbished devices into their IT strategies, reflecting a shift in corporate purchasing behavior. This trend not only supports the refurbished computers and laptops market but also encourages a broader acceptance of refurbished technology in professional settings.

Increased Online Retailing

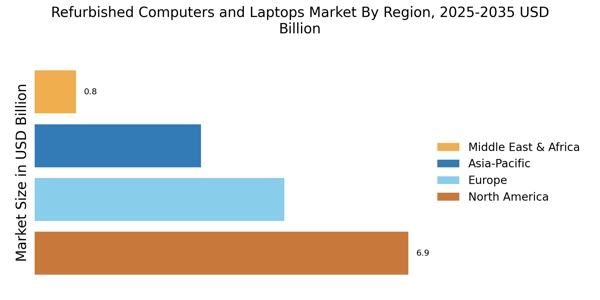

The surge in online retailing has transformed the refurbished computers and laptops market. E-commerce platforms provide consumers with easy access to a wide range of refurbished products, enhancing visibility and convenience. This shift has led to a significant increase in sales, as consumers can compare prices, read reviews, and make informed decisions from the comfort of their homes. Data shows that online sales of refurbished electronics have grown by over 30% in the past year, indicating a strong consumer preference for purchasing these products online. The refurbished computers and laptops market is thus well-positioned to capitalize on this trend, as more consumers turn to digital platforms for their purchasing needs.

Technological Advancements

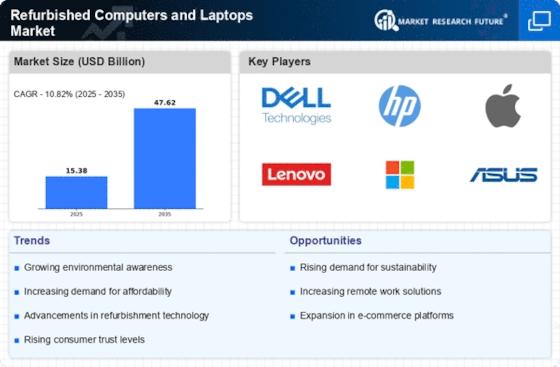

Rapid advancements in technology play a crucial role in shaping the refurbished computers and laptops market. As new models are released, older versions become available for refurbishment, often equipped with still-relevant features and capabilities. This influx of refurbished devices allows consumers to access high-performance technology at lower prices. Recent statistics suggest that the refurbished market has seen a growth rate of approximately 20% annually, driven by the continuous innovation in hardware and software. Consequently, consumers are more inclined to purchase refurbished products, knowing they can obtain devices that meet their needs without the premium price tag associated with the latest models.

Environmental Sustainability

Growing awareness of environmental issues significantly influences the refurbished computers and laptops market. Consumers are increasingly concerned about electronic waste and the carbon footprint associated with manufacturing new devices. Refurbished products offer a sustainable solution by extending the lifecycle of existing technology. Data indicates that the production of new electronics contributes to substantial greenhouse gas emissions, whereas refurbishing reduces waste and conserves resources. As a result, environmentally conscious consumers are more likely to choose refurbished devices, thereby propelling the growth of the refurbished computers and laptops market. This trend aligns with broader sustainability goals, as individuals and organizations strive to minimize their environmental impact.