Market Trends

Key Emerging Trends in the Refrigerated Truck Market

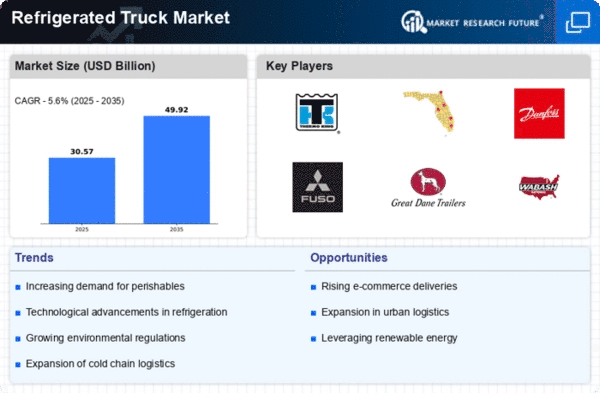

The refrigerated truck market is experiencing significant trends driven by various factors such as technological advancements, regulatory requirements, changing consumer preferences, and industry dynamics. Refrigerated trucks, also known as reefers, play a crucial role in the transportation and distribution of perishable goods such as fresh produce, dairy products, pharmaceuticals, and frozen foods.

One significant trend in the refrigerated truck market is the increasing demand for energy-efficient and environmentally friendly refrigeration systems. With growing concerns about climate change and air pollution, there is a rising preference for refrigerated trucks equipped with advanced refrigeration units that minimize greenhouse gas emissions and reduce fuel consumption. Manufacturers are responding to this trend by developing eco-friendly refrigeration technologies such as electric-powered systems, hybrid systems, and alternative refrigerants that offer lower carbon footprint and higher energy efficiency compared to traditional diesel-powered units.

There are multiple sectors where cold-chain transport is required. The refrigerated truck market share relies on sectors like processed food, frozen food, packaged food and beverages, pharmaceutical supplies, chemical supplies, etc. In that manner, the chain of a network of refrigerated trucks is quite valuable. The co-dependence between manufacturers and cold-chain transport for temperature-sensitive products maintains the increase of the market.

Moreover, technological advancements are driving innovation and adoption of smart refrigerated truck systems that offer enhanced monitoring, control, and connectivity capabilities. Advanced telematics, GPS tracking, and remote monitoring systems enable real-time monitoring of temperature, humidity, and location data for perishable cargo, ensuring compliance with food safety regulations and maintaining product integrity throughout the transportation process. Additionally, IoT (Internet of Things) sensors and predictive analytics enable proactive maintenance scheduling, fault detection, and optimization of refrigeration system performance, reducing downtime and enhancing operational efficiency for fleet operators.

Furthermore, customization and flexibility are emerging trends in the refrigerated truck market as businesses seek tailored solutions to meet specific transportation requirements and operational needs. Manufacturers are offering a wide range of customization options, including various truck sizes, configurations, temperature ranges, and cargo capacity, to accommodate diverse product types and distribution channels. Customized refrigerated trucks equipped with multi-temperature zones, adjustable shelving, and partitioning systems provide flexibility and versatility for transporting different types of perishable goods simultaneously, optimizing logistics efficiency and reducing transportation costs.

The rise of e-commerce and direct-to-consumer delivery models is also driving demand for refrigerated trucks that can accommodate the growing volume of online grocery orders and fresh food deliveries. With the increasing popularity of online shopping and home delivery services, there is a growing need for refrigerated trucks equipped with temperature-controlled compartments and last-mile delivery capabilities to ensure the freshness and quality of perishable goods during transit. Refrigerated e-commerce platforms and mobile apps enable consumers to track their orders in real-time and schedule convenient delivery windows, enhancing the overall shopping experience and customer satisfaction.

Supply chain resilience and traceability have become critical considerations for food manufacturers, retailers, and logistics providers in the wake of global health crises such as the COVID-19 pandemic. Refrigerated trucks play a vital role in ensuring the safe and hygienic transport of perishable food products from production facilities to distribution centers and retail stores. As companies strive to maintain high standards of food safety and traceability, the demand for reliable and compliant refrigerated truck solutions with temperature-controlled environments and advanced monitoring capabilities is expected to remain strong.

Leave a Comment