Market Analysis

In-depth Analysis of Refrigerated Truck Market Industry Landscape

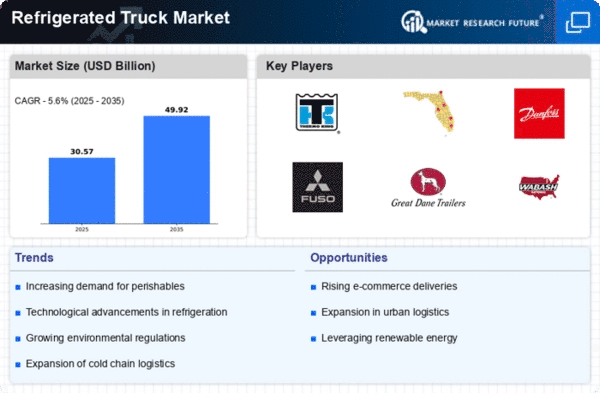

The Refrigerated Truck Market operates within a dynamic environment shaped by various factors that influence its growth, trends, and competition. One significant dynamic is the increasing demand for cold chain logistics solutions driven by the growing global food industry. As consumer preferences evolve towards fresh and perishable food products, there is a rising need for reliable and efficient transportation of temperature-sensitive goods. Refrigerated trucks, equipped with temperature-controlled compartments, offer a solution for transporting perishable items such as fruits, vegetables, dairy products, meat, and pharmaceuticals over long distances. Companies in the Refrigerated Truck Market are responding to this demand by providing a wide range of refrigerated truck options with advanced cooling systems and temperature monitoring capabilities to ensure the integrity and safety of transported goods.

Another key market dynamic is the expansion of the e-commerce and online grocery sectors, which has increased the demand for refrigerated transport services. With the rise of online shopping and home delivery services, there is a growing need for refrigerated trucks to transport fresh and frozen goods directly to consumers' doorsteps. Refrigerated trucks play a crucial role in maintaining the cold chain from distribution centers to final delivery points, ensuring that perishable items reach customers in optimal condition. Companies are capitalizing on this trend by investing in fleet expansion and technology upgrades to meet the growing demand for refrigerated transport services in the e-commerce sector. An increase in e-commerce portals, last-mile deliveries also work in the favour of refrigerated truck market size. It is a striving market growing rapidly in the pharmaceutical industry due to the COVID-19 pandemic. The increase in the transportation of life-saving medical drugs, vaccines, general medicines, supplements, and others will create a lot of requirements for reefer trucks in the future.

Furthermore, regulatory standards and safety requirements play a significant role in shaping market dynamics in the Refrigerated Truck Market. Government regulations related to food safety, transportation standards, and emissions control impact the design, manufacturing, and operation of refrigerated trucks. Companies must comply with these regulations to ensure the quality, safety, and environmental sustainability of their refrigerated truck fleets. As a result, there is a growing focus on developing refrigerated truck solutions that meet regulatory standards and address industry-specific requirements, such as HACCP compliance, ATP certification, and emissions reduction technologies.

Moreover, technological advancements drive market dynamics in the Refrigerated Truck Market. Advances in refrigeration systems, insulation materials, and telematics technology have led to the development of more efficient and reliable refrigerated truck solutions. For example, the adoption of eco-friendly refrigerants, improved insulation materials, and advanced temperature monitoring systems enhance the energy efficiency, temperature control, and cargo visibility of refrigerated trucks. Companies that invest in research and development to integrate these technological innovations into their truck designs can gain a competitive edge and meet the evolving needs of customers in the Refrigerated Truck Market.

Supply chain dynamics also play a crucial role in shaping market dynamics in the Refrigerated Truck Market. Factors such as fleet capacity, driver availability, fuel prices, and infrastructure development impact the availability and cost of refrigerated transport services. Companies must optimize their supply chain processes to ensure timely delivery, minimize costs, and maintain service quality. Fluctuations in demand, seasonal variations, and unexpected disruptions can also influence capacity utilization and pricing strategies within the market, requiring companies to remain agile and responsive to market dynamics.

Furthermore, shifting consumer preferences and industry trends influence the demand for refrigerated trucks in the market. As consumers increasingly prioritize convenience, freshness, and sustainability in their purchasing decisions, there is a growing demand for refrigerated transport services across various sectors, including food and beverage, pharmaceuticals, and floral industry. Refrigerated trucks are preferred for their ability to maintain precise temperature control, ensuring that perishable items reach their destination in optimal condition. Companies that innovate and differentiate themselves through fleet modernization, cold chain management solutions, and customer service excellence can succeed in capturing market share and maintaining a competitive position in the Refrigerated Truck Market.

Leave a Comment