Market Trends and Projections

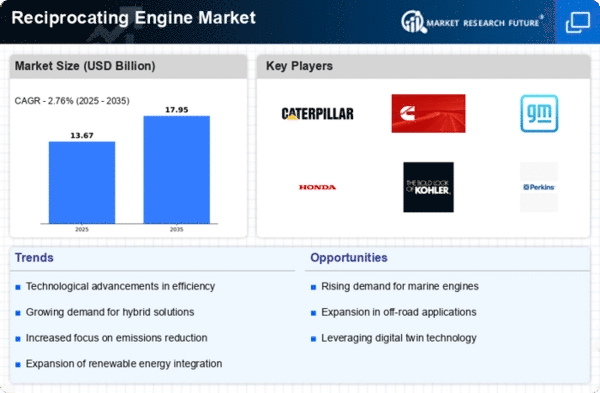

The Global Reciprocating Engine Market Industry is poised for growth, with projections indicating a market size of 13.0 USD Billion in 2024 and an anticipated increase to 17.5 USD Billion by 2035. The compound annual growth rate is estimated at 2.73% from 2025 to 2035. These figures suggest a steady demand for reciprocating engines driven by various factors, including technological advancements, regulatory support, and industrial applications. The market's trajectory appears promising, reflecting the ongoing evolution of energy solutions and the critical role of reciprocating engines in meeting global energy demands.

Increasing Industrial Applications

The Global Reciprocating Engine Market Industry is bolstered by the rising adoption of reciprocating engines across various industrial applications. Industries such as manufacturing, oil and gas, and transportation are increasingly utilizing these engines for their versatility and reliability. The ability to operate efficiently in diverse environments makes reciprocating engines a preferred choice for powering machinery and equipment. As industries expand and modernize, the demand for robust power solutions is expected to rise, further propelling market growth. This trend is indicative of a broader shift towards more efficient energy solutions that can support industrial growth and sustainability.

Growing Demand for Power Generation

The Global Reciprocating Engine Market Industry is experiencing a surge in demand for power generation solutions, particularly in developing regions. As countries strive to enhance their energy infrastructure, reciprocating engines are favored for their efficiency and reliability. In 2024, the market is projected to reach 13.0 USD Billion, driven by the need for stable power supply in industrial and residential sectors. This trend is likely to continue, with projections indicating a market size of 17.5 USD Billion by 2035, reflecting a compound annual growth rate of 2.73% from 2025 to 2035. Such growth underscores the critical role of reciprocating engines in meeting global energy needs.

Expansion of Renewable Energy Integration

The integration of renewable energy sources into existing power grids is driving the Global Reciprocating Engine Market Industry. Reciprocating engines are increasingly being used as backup power sources to complement intermittent renewable energy generation, such as solar and wind. Their ability to provide reliable and flexible power makes them an attractive option for energy providers looking to enhance grid stability. As the global energy landscape evolves, the demand for reciprocating engines that can seamlessly integrate with renewable sources is expected to rise. This trend reflects a broader commitment to achieving energy diversification and sustainability.

Regulatory Support for Cleaner Technologies

Regulatory frameworks promoting cleaner technologies are significantly influencing the Global Reciprocating Engine Market Industry. Governments worldwide are implementing stringent emissions standards and incentivizing the adoption of low-emission technologies. This regulatory support encourages manufacturers to innovate and develop cleaner reciprocating engines, which can operate on alternative fuels such as natural gas and biofuels. As a result, the market is likely to see a shift towards engines that not only comply with regulations but also meet the growing consumer demand for environmentally friendly solutions. This alignment with regulatory trends is crucial for the sustained growth of the market.

Technological Advancements in Engine Design

Technological innovations are reshaping the Global Reciprocating Engine Market Industry, enhancing performance and efficiency. Advances in materials, fuel injection systems, and control technologies contribute to improved engine output and reduced emissions. Manufacturers are increasingly adopting these innovations to meet stringent environmental regulations and consumer expectations for cleaner energy solutions. The integration of smart technologies, such as IoT and AI, into engine management systems further optimizes performance and maintenance. This trend not only boosts the market's appeal but also aligns with global sustainability goals, positioning reciprocating engines as a viable option in the transition to greener energy sources.