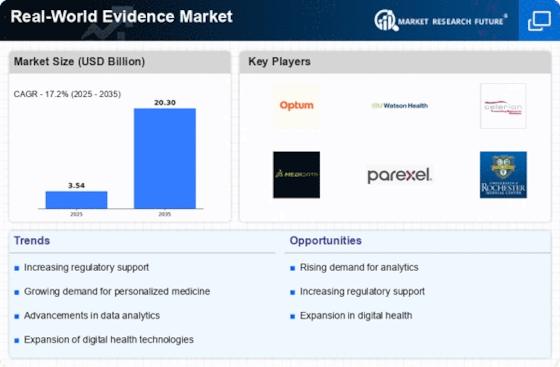

Growing Demand for Personalized Medicine

The Real-World Evidence Market is experiencing a notable shift towards personalized medicine, driven by the increasing demand for tailored treatment options. As healthcare providers and pharmaceutical companies seek to enhance patient outcomes, the integration of real-world evidence into clinical decision-making becomes paramount. This trend is underscored by the fact that approximately 70% of patients express a preference for treatments that are customized to their unique genetic profiles. Consequently, the Real-World Evidence Market is likely to expand as stakeholders leverage real-world data to identify effective therapies for specific patient populations, thereby improving therapeutic efficacy and safety.

Increased Focus on Regulatory Compliance

The Real-World Evidence Market is also shaped by an increased focus on regulatory compliance. Regulatory bodies are progressively recognizing the importance of real-world evidence in supporting drug approvals and post-market surveillance. For instance, the FDA has issued guidelines encouraging the use of real-world data to inform regulatory decisions. This shift is indicative of a broader trend where regulatory frameworks are evolving to accommodate the integration of real-world evidence into the drug development lifecycle. As compliance becomes more stringent, the Real-World Evidence Market is expected to expand, as companies seek to align their practices with regulatory expectations.

Rising Healthcare Costs and Value-Based Care

The Real-World Evidence Market is significantly influenced by the rising healthcare costs and the shift towards value-based care models. As healthcare expenditures continue to escalate, stakeholders are increasingly focused on demonstrating the value of treatments through real-world evidence. Reports indicate that healthcare costs are projected to reach over 10 trillion dollars by 2025, prompting payers and providers to seek evidence that supports the effectiveness and cost-efficiency of interventions. This trend is likely to drive the adoption of real-world evidence methodologies, as they provide critical insights into treatment outcomes and resource utilization, ultimately shaping reimbursement strategies.

Advancements in Data Analytics and Technology

The Real-World Evidence Market is poised for growth due to advancements in data analytics and technology. The proliferation of electronic health records, wearable devices, and mobile health applications has generated vast amounts of real-world data. This data, when analyzed effectively, can yield valuable insights into patient behaviors, treatment responses, and long-term outcomes. It is estimated that the global market for healthcare analytics will surpass 50 billion dollars by 2026, indicating a robust demand for innovative analytical solutions. As organizations increasingly harness these technologies, the Real-World Evidence Market is likely to benefit from enhanced data-driven decision-making capabilities.

Growing Interest from Pharmaceutical Companies

The Real-World Evidence Market is witnessing a growing interest from pharmaceutical companies, which are increasingly utilizing real-world evidence to inform their research and development strategies. This trend is driven by the need to demonstrate the real-world effectiveness of new therapies to gain market access and reimbursement. Recent studies suggest that over 60% of pharmaceutical executives consider real-world evidence essential for their product development processes. As these companies invest in real-world data initiatives, the Real-World Evidence Market is likely to experience substantial growth, reflecting the critical role of real-world evidence in shaping the future of drug development.