Growing Adoption in Healthcare

The Real-Time Locating Systems Market is witnessing significant growth in the healthcare sector, where the need for efficient patient and equipment management is paramount. Hospitals and healthcare facilities are increasingly implementing real-time locating systems to track medical equipment, monitor patient locations, and enhance overall operational efficiency. Reports indicate that the healthcare segment is expected to account for a substantial share of the market, with a projected growth rate of around 18% annually. This trend is largely attributed to the rising emphasis on patient safety and the need for timely access to critical medical resources, which real-time locating systems can effectively provide.

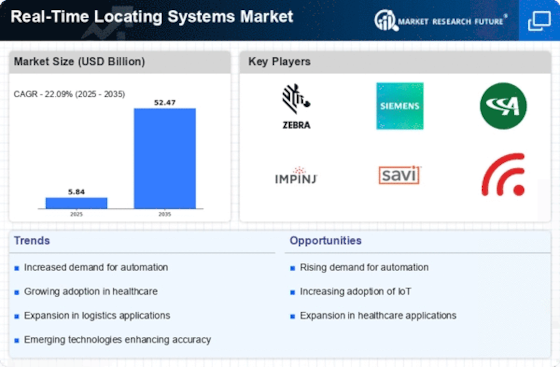

Increased Demand for Asset Tracking

The Real-Time Locating Systems Market is experiencing heightened demand for asset tracking solutions across various sectors. Organizations are increasingly recognizing the value of real-time visibility into their assets, which enhances operational efficiency and reduces losses. According to recent estimates, the asset tracking segment is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This surge is driven by the need for improved inventory management and the ability to monitor high-value assets in real-time. As businesses strive to optimize their supply chains, the adoption of real-time locating systems becomes essential, thereby propelling the market forward.

Enhancements in Supply Chain Management

The Real-Time Locating Systems Market is significantly influenced by advancements in supply chain management practices. Companies are increasingly adopting real-time locating systems to streamline their logistics and inventory processes. By providing accurate location data, these systems enable organizations to reduce delays, optimize routes, and improve overall supply chain visibility. Market analysis suggests that the integration of real-time locating systems in supply chain operations could lead to cost reductions of up to 15% in logistics expenses. As businesses seek to enhance their operational capabilities, the demand for these systems is likely to continue its upward trajectory.

Regulatory Compliance and Safety Standards

The Real-Time Locating Systems Market is also influenced by the growing emphasis on regulatory compliance and safety standards across various sectors. Industries such as manufacturing, healthcare, and logistics are facing stringent regulations that necessitate the implementation of tracking systems to ensure safety and accountability. Compliance with these regulations often requires real-time monitoring of assets and personnel, which real-time locating systems can provide. As organizations strive to meet these regulatory demands, the market for RTLS solutions is expected to expand, with a projected growth rate of around 17% in the coming years. This trend underscores the critical role of real-time locating systems in maintaining compliance and enhancing safety.

Technological Advancements in RTLS Solutions

The Real-Time Locating Systems Market is propelled by continuous technological advancements in RTLS solutions. Innovations such as improved sensor technologies, enhanced data analytics, and integration with cloud computing are transforming the capabilities of real-time locating systems. These advancements enable more accurate tracking and better data management, which are crucial for businesses aiming to leverage real-time information for decision-making. The market is expected to see a growth rate of approximately 22% in the next few years, driven by these technological improvements. As organizations increasingly rely on data-driven strategies, the demand for sophisticated RTLS solutions is likely to rise.