Top Industry Leaders in the Rainscreen Cladding Market

The rainscreen cladding market boasts a dynamic landscape teeming with established players and nimble newcomers. it's no surprise that the battle for market share intensifies with each passing quarter. Here's a comprehensive analysis of the competitive landscape, encompassing:

The rainscreen cladding market boasts a dynamic landscape teeming with established players and nimble newcomers. it's no surprise that the battle for market share intensifies with each passing quarter. Here's a comprehensive analysis of the competitive landscape, encompassing:

List of Strategies Adopted:

-

Product Diversification: Key players like Kingspan and Rockwool are expanding their offerings, from traditional metal panels to eco-friendly composites and terracotta, catering to diverse aesthetics and sustainability demands. -

Geographical Expansion: Companies like Alucobond and Trespa are aggressively venturing into emerging markets like Asia and South America, capitalizing on the burgeoning construction sectors. -

R&D Investments: Leading manufacturers like Sto and Saint-Gobain are pouring resources into developing innovative materials, fire-resistant solutions, and self-cleaning technologies, staying ahead of the curve. -

Strategic Partnerships: Collaborations with architects, engineering firms, and construction giants are fostering knowledge sharing and opening doors to new projects. -

Sustainability Focus: The rise of green building norms is prompting companies to adopt eco-friendly practices, with recycled materials and low-energy production processes gaining traction. -

Digital Transformation: Embracing online platforms, BIM tools, and virtual reality solutions are streamlining the design, estimation, and installation processes, enhancing customer experience.

Factors for Market Share:

-

Brand Reputation: Established players like Trespa and Eternit leverage their longstanding reputation for quality and reliability, while smaller companies focus on niche offerings and competitive pricing. -

Cost and Performance: Balancing affordability with robust performance remains crucial. Metal panels offer cost-effectiveness while composite materials, though pricier, excel in aesthetics and insulation. -

Geographical Presence: Strong regional networks and efficient distribution channels provide an edge, particularly in fragmented markets like Asia. -

Sustainability Credentials: Companies with demonstrably eco-friendly practices and certifications like FSC or LEED attract environmentally conscious clientele. -

Innovation and Customization: Continuously evolving product lines and the ability to cater to bespoke design requirements foster brand loyalty and project wins.

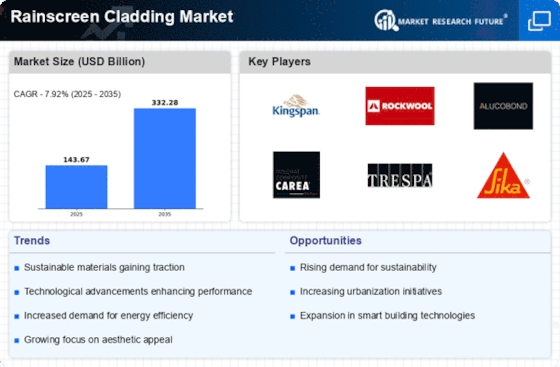

Key Players

-

Kingspan Insulation PLC

-

Carea Ltd.

-

MF Murray Companies

-

Celotex Ltd.

-

CGL Facades Ltd.

-

Rockwool International A/S

-

Eco Earth Solutions

-

Sika Corporation

-

FunderMax Holding AG

-

Euramax

-

Trespa International B.V. among others

Recent Developments :

March 2022: CGL Facades announced its new rainscreen cladding systems passed weather testing and fire performance tests.

November 2023: The American Institute of Architects (AIA) released its annual report on trends in building envelope design. The report found that rainscreen cladding is becoming increasingly popular among architects, as it offers a number of advantages over traditional cladding systems, such as improved energy efficiency, durability, and sustainability.

November 2021: Sika Corporation announced a collaboration with Omnis Panels in US Rainscreen Market.

October 2023: Sto Corp., a leading provider of building envelope systems, announced the launch of its new StoVentec® rainscreen cladding system. The new system is designed to offer architects and builders a more flexible and efficient rainscreen cladding solution, with a variety of installation options available.