Focus on Sustainability

The increasing focus on sustainability is reshaping the Railway Traction Motor Market. As environmental concerns gain prominence, rail operators are seeking to reduce their carbon footprints. The shift towards electric traction systems is a direct response to this demand, as electric trains are generally more environmentally friendly compared to their diesel counterparts. Moreover, the adoption of regenerative braking systems in electric trains allows for energy recovery, further enhancing sustainability. This trend is likely to drive the demand for innovative traction motors that support these eco-friendly technologies. Consequently, the Railway Traction Motor Market is expected to expand as stakeholders prioritize sustainable solutions in their operations.

Technological Advancements

Technological advancements in the design and manufacturing of traction motors are significantly influencing the Railway Traction Motor Market. Innovations such as the development of high-efficiency permanent magnet motors and improved cooling systems are enhancing the performance and reliability of traction motors. These advancements are crucial as they allow for higher power outputs and reduced energy consumption. Furthermore, the integration of smart technologies, such as predictive maintenance and real-time monitoring, is becoming increasingly prevalent. This not only optimizes the operational efficiency of rail systems but also extends the lifespan of traction motors. As a result, the Railway Traction Motor Market is poised for growth, driven by the demand for more efficient and technologically advanced solutions.

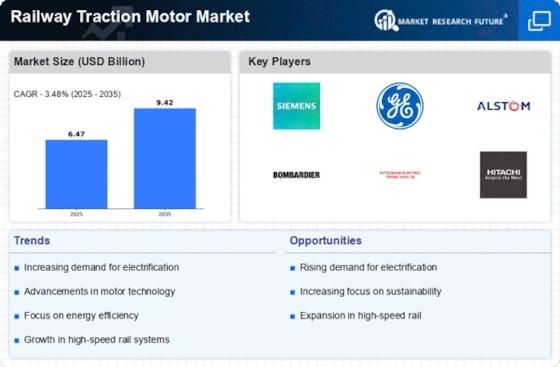

Electrification Initiatives

The ongoing electrification initiatives across various regions are propelling the Railway Traction Motor Market. Governments are increasingly investing in electrified rail systems to enhance energy efficiency and reduce carbon emissions. For instance, the transition from diesel to electric traction systems is expected to lead to a substantial increase in the demand for traction motors. Reports indicate that the electrification of rail networks could potentially reduce operational costs by up to 30%, thereby making rail transport more competitive. This shift not only supports environmental goals but also aligns with the global push for sustainable transportation solutions. As a result, the Railway Traction Motor Market is likely to witness a surge in demand for advanced electric traction motors that meet the evolving standards of efficiency and performance.

Rising Urbanization and Commuter Demand

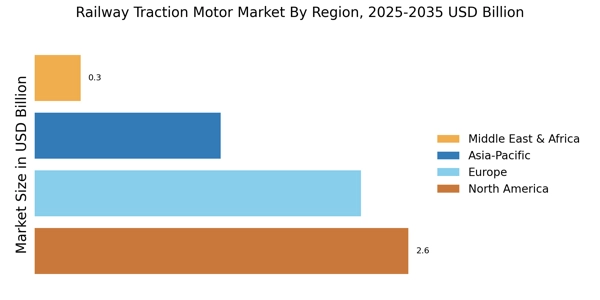

Rising urbanization and the corresponding increase in commuter demand are significant factors influencing the Railway Traction Motor Market. As urban populations grow, the need for efficient public transport systems becomes more critical. Rail transport is often viewed as a viable solution to alleviate congestion and provide reliable transit options. This surge in demand for urban rail systems, including metros and light rail, is likely to drive the need for traction motors that can operate effectively in densely populated areas. Furthermore, the emphasis on reducing travel times and improving service frequency is pushing rail operators to invest in advanced traction technologies. Thus, the Railway Traction Motor Market is expected to benefit from this trend as it aligns with the evolving needs of urban transportation.

Government Investments in Rail Infrastructure

Government investments in rail infrastructure are a key driver of the Railway Traction Motor Market. Many countries are prioritizing the expansion and modernization of their rail networks, recognizing the economic and environmental benefits of efficient rail transport. For example, substantial funding has been allocated for the development of high-speed rail projects, which necessitate advanced traction motors capable of supporting higher speeds and loads. This trend is expected to create a robust demand for traction motors that can meet the specific requirements of modern rail systems. Additionally, public-private partnerships are emerging as a viable model for financing these projects, further stimulating growth in the Railway Traction Motor Market.