Quinoa Seeds Size

Quinoa Seeds Market Growth Projections and Opportunities

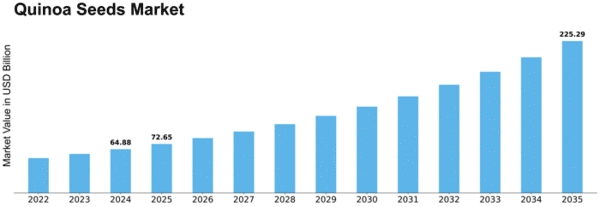

Various factors have a bearing on the dynamics of the Quinoa Seeds market and its growth path. Among these is one key factor which is increasing awareness of healthy food alternatives as well as demand for them. The Quinoa Seeds Market’s future looks promising with a strong CAGR of 13.80% over the period under consideration ending at USD 160.368 billion by December 2032. This significant expansion underscores rising global demand for quinoa seeds due to their known nutritional advantages and universal use in culinary. Due to its rich protein content, essential amino acids, and gluten-free nature, quinoa has become a staple among consumers who are turning to healthier eating habits. The projected CAGR indicates that the quinoa market will maintain its current pace while shifting towards health-oriented consumption trends. Additionally, quinoa’s flexibility makes it suitable for all types of cuisines globally hence it is adopted worldwide. This rapid growth shows that there is a growing market that can be tapped into by major industry players seeking sustainable sources of nutritious food products. Quinoa leads this way as other markets recover from an unwise approach to nutrition and balanced consumption in general terms. Stakeholders wait expectantly as the conditions unfold knowing that they stand ready to ensure that quinoa retains its position as one of the most sought superfoods today.

Agricultural practices together with technological advancements also shape The Quinoa seeds market . Innovations in farming techniques, irrigation methods and seed development contribute to increased quinoa growth rates and improved crop yields. Recognizing these preferences among environmentally-conscious buyers, sustainable and organic farming methods are increasingly being embraced. The market is thus shifting to sustainable and eco-friendly quinoa farming practices.

Market competition as well as supply chain trends are other factors that influence the Quinoa Seeds market. These include farmers, processors and distributors among others making markets for them fairly competitive. Suitable supply chain management makes it possible for quinoa seeds to reach consumers at the right time and at affordable prices. Changes in transportation costs, logistics, and storage facilities can affect the overall market dynamics.

Leave a Comment