Technological Advancements

The Global Push Buttons and Signaling Devices Market Industry experiences a surge in demand driven by rapid technological advancements. Innovations in smart technology and automation are reshaping the landscape, enabling more efficient and user-friendly devices. For instance, the integration of IoT capabilities allows for remote monitoring and control, enhancing operational efficiency. As industries increasingly adopt these technologies, the market is projected to grow from 2.21 USD Billion in 2024 to 3.81 USD Billion by 2035, reflecting a compound annual growth rate of 5.1% from 2025 to 2035. This trend underscores the importance of staying abreast of technological developments to maintain competitive advantage.

Industrial Automation Growth

The ongoing expansion of industrial automation significantly influences the Global Push Buttons and Signaling Devices Market Industry. As manufacturers seek to enhance productivity and reduce operational costs, the adoption of automated systems becomes paramount. Push buttons and signaling devices serve as critical components in these systems, facilitating seamless communication and control. The increasing focus on smart factories and Industry 4.0 initiatives further propels this demand. With the market expected to reach 3.81 USD Billion by 2035, the integration of these devices into automated processes is likely to become a standard practice across various sectors.

Safety Regulations and Standards

Stringent safety regulations and standards play a pivotal role in shaping the Global Push Buttons and Signaling Devices Market Industry. Governments and regulatory bodies worldwide are implementing comprehensive safety guidelines to ensure the protection of workers and equipment. Compliance with these regulations necessitates the use of reliable signaling devices and push buttons, which are essential for emergency stops and alerts. As industries prioritize safety, the demand for certified devices is expected to rise, contributing to market growth. The emphasis on safety not only enhances operational reliability but also fosters a culture of accountability within organizations.

Rising Demand in Emerging Markets

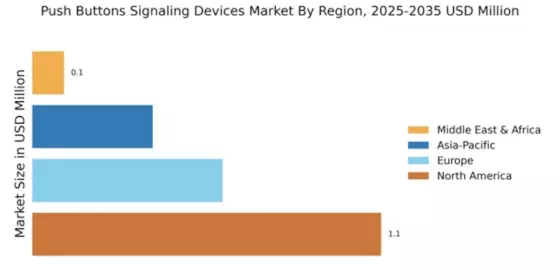

Emerging markets present a substantial opportunity for the Global Push Buttons and Signaling Devices Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to increased investments in infrastructure and manufacturing. This trend drives the demand for signaling devices and push buttons, which are integral to various applications, including transportation, construction, and manufacturing. As these regions continue to develop, the market is likely to expand, with projections indicating a growth trajectory that aligns with global trends. The potential for market penetration in these areas remains significant.

Increased Focus on Energy Efficiency

The Global Push Buttons and Signaling Devices Market Industry is increasingly influenced by the global emphasis on energy efficiency and sustainability. Industries are actively seeking solutions that minimize energy consumption while maintaining operational effectiveness. Push buttons and signaling devices that incorporate energy-saving features are gaining traction, as they align with corporate sustainability goals. This shift not only reduces operational costs but also contributes to environmental conservation efforts. As the market evolves, the integration of energy-efficient technologies is expected to play a crucial role in driving growth and meeting the demands of environmentally conscious consumers.