Pulses Ingredients Size

Pulses Ingredients Market Growth Projections and Opportunities

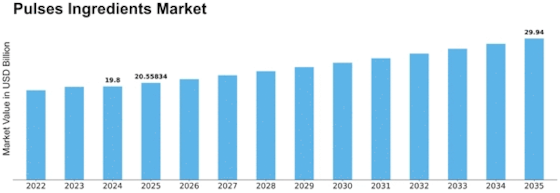

The market for the Pulses Ingredients is seen to be affected by numerous determining elements that, in turn, determine the growth rate and structure of the market. Doubting factor is the growing belief that pulses is these super foods. Chickpeas, lentil, peas, or beans, depending on your preference are all powerful sources of protein, fiber, and vitamins. In parallel with consumers taking interest in health-proficiency and favoring plant-based protein, pulses have become popular ingredients, part of food industry developments and the increasing demand for such ingredients that are nutritious and have multiple uses. For the year 2022 the total worth of Pulses Ingredients Industry has reached an estimation of USD 18.2 B, which forms the base for a promising future growth. The industry revenue captures this impressive figure, with the two-way traffic between 2023 and 2032 expected to go from USD 19.0 billion to USD 26.8 billion. These trends show an annual accelerating growth based on the rate of CAGR which amounts to 4.4% over a period of 10 years beginning from 2023 until 2032.

The growth in market size suggests the initial pulse’s advocates as well as the subsequent and steady shift in the general population’s focus on this product across a wide range of industries. Through the patronage of pulses, known as precious sources of healthy nutrients, as well as versatile components of many dishes, they are gradually occupying the center stage of numerous foods. This expansion is based on employing factors namely restructuring of the dietary patterns, growing consciousness of health benefits, and using pulses as the core ingredient in new innovative types of food products.

By this broadening of horizons, one may also note that the pulses industry is responding responsibly to these trends of clean and plant-based alternatives which are increasing worldwide and pulses are gaining a central role in all these. The integrating of the pulses ingredients market to the economy, which is evidenced by the rising curve of the pulse market, is a vital component that will be determining the future of the food and the drinks sector. Apart from conducting some conventional market research, study of global agricultural conditions plays a big part in the development of world market pulses ingredients. Pulse crops are rainfed in every agro-ecological zone and as a result variations in weather patterns, soil conditions, and practices in the farm can influence the production and quality of the pulse crops. Shift in climate, accessibility of usable land, and sustainable farming technique are those key sources which have a direct bearing on the overall availability of this inputs. This has a fundamental impact on the market dynamics and pricing of pulses commodity.

There are many influences from economic points of view which influence the growth of the ingredients market for pulses. The low cost in comparison with other foods ingredients as well as the basing of pulses on single or various food products, makes pulses an attractive choice. The economic conditions, such as the income level, and the inflation of the currency may present an advantage or disadvantage in the market depending on the purchasing power of individuals and the occurring changes within the market.

Leave a Comment