Market Trends

Key Emerging Trends in the Public Safety LTE Market

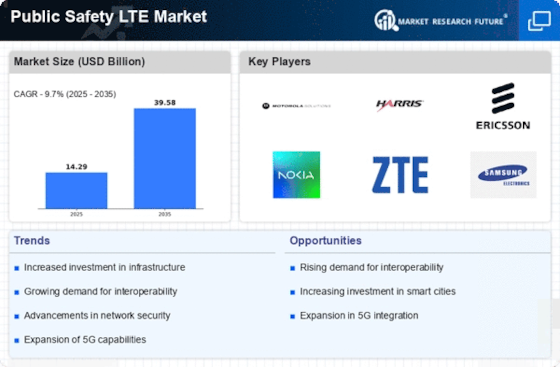

The market trends of the Public Safety LTE (PS-LTE) sector exhibit a dynamic landscape driven by a fusion of technological advancements and evolving security needs. With the global shift towards digitalization and the increasing demand for robust communication infrastructure in emergency response scenarios, the PS-LTE market has experienced significant growth. One prominent trend is the adoption of LTE-based networks by public safety agencies worldwide, replacing traditional radio systems with high-speed broadband connections. This transition allows for seamless data transmission, video streaming, and real-time collaboration among first responders, enhancing overall operational efficiency and situational awareness.

Furthermore, the emergence of integrated solutions leveraging LTE technology has become a key focus within the market. These solutions encompass not only communication networks but also incorporate elements such as IoT sensors, AI-powered analytics, and geospatial mapping tools. By integrating these technologies, public safety agencies can create comprehensive systems capable of preemptive threat detection, rapid response coordination, and effective resource allocation. Such integrated approaches are reshaping the landscape of emergency response, facilitating more proactive strategies to mitigate risks and ensure public safety.

Another notable trend driving the PS-LTE market is the increasing emphasis on interoperability and standardization. As public safety agencies collaborate across jurisdictions and disciplines, the need for seamless communication and compatibility between different systems becomes paramount. Consequently, industry stakeholders are working towards establishing common standards and protocols to enable interoperability between LTE networks deployed by various agencies. This trend not only fosters greater collaboration during emergency situations but also facilitates the integration of diverse technologies and devices into a unified ecosystem.

Moreover, the evolution of LTE technology itself is shaping the trajectory of the PS-LTE market. The transition towards 5G networks promises even higher data speeds, lower latency, and greater network capacity, unlocking new possibilities for public safety applications. With 5G, first responders can leverage advanced functionalities such as augmented reality overlays, remote drone operations, and autonomous vehicle coordination, revolutionizing emergency response capabilities. As 5G infrastructure continues to expand globally, it is expected to catalyze further growth and innovation within the PS-LTE market.

Additionally, the market is witnessing a growing trend towards private LTE networks tailored specifically for public safety use cases. These dedicated networks offer enhanced security, prioritized bandwidth, and greater control over network management, addressing the unique requirements of emergency response operations. By deploying private LTE infrastructure, public safety agencies can ensure reliable communication and data connectivity in challenging environments such as disaster zones or densely populated urban areas where commercial networks may become congested or compromised.

Furthermore, the COVID-19 pandemic has underscored the importance of resilient communication networks in supporting emergency response efforts. As governments and organizations worldwide grapple with managing the crisis, there has been renewed focus on investing in robust infrastructure to enable effective communication and coordination during emergencies. This heightened awareness of the critical role played by PS-LTE networks in crisis management is expected to drive sustained growth in the market in the coming years.

Leave a Comment