Market Analysis

In-depth Analysis of Public Safety LTE Market Industry Landscape

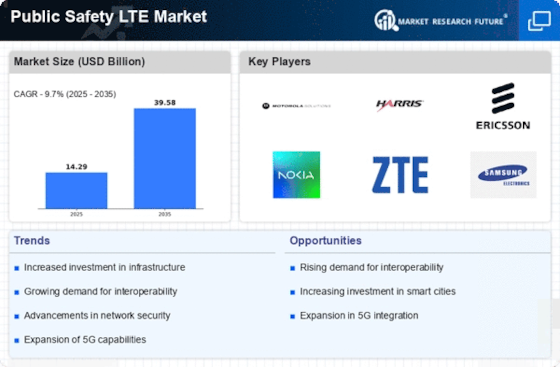

The public safety LTE market is characterized by a complex interplay of various factors that influence its dynamics. One key aspect is the increasing demand for advanced communication technologies among public safety agencies worldwide. As these agencies strive to enhance their operational efficiency and response capabilities, the need for robust and reliable LTE-based communication solutions has grown significantly. Moreover, the proliferation of smartphones and other connected devices has fueled the adoption of LTE networks for public safety applications, facilitating seamless data exchange and real-time collaboration in emergency situations.

Another factor shaping the market dynamics is the evolving regulatory landscape governing public safety communications. Governments and regulatory bodies are continually updating standards and guidelines to ensure interoperability, spectrum availability, and cybersecurity in LTE networks dedicated to public safety. Compliance with these regulations is essential for market players to gain trust and confidence from government agencies and secure lucrative contracts.

Furthermore, technological advancements and innovations play a crucial role in driving market dynamics. Companies operating in the public safety LTE space are constantly investing in research and development to introduce new features and functionalities that address the evolving needs of end-users. These may include mission-critical voice communication, video surveillance, location tracking, and IoT integration, among others. The ability of market players to innovate and adapt to emerging trends significantly influences their competitiveness and market share.

Moreover, the competitive landscape of the public safety LTE market is characterized by intense rivalry among key players. Established telecommunications companies, as well as specialized providers focusing solely on public safety solutions, compete for market share through product differentiation, pricing strategies, and geographic expansion. Additionally, partnerships and collaborations between vendors, system integrators, and government agencies are common, enabling a broader range of offerings and enhanced service delivery.

Market dynamics are also influenced by macroeconomic factors such as budgetary constraints and geopolitical tensions. Government spending on public safety initiatives fluctuates based on economic conditions and political priorities, impacting procurement decisions and project timelines. Moreover, global events such as natural disasters, terrorist threats, and pandemics can trigger sudden spikes in demand for public safety LTE solutions, driving market growth in the short term.

In addition to these factors, end-user preferences and evolving use cases shape the trajectory of the public safety LTE market. Public safety agencies are increasingly leveraging LTE networks for data-intensive applications such as real-time video streaming, drone operations, and augmented reality, necessitating higher bandwidth and low latency capabilities. Moreover, the growing emphasis on data analytics and predictive modeling to enhance situational awareness and decision-making further drives the adoption of LTE-based solutions.

Leave a Comment