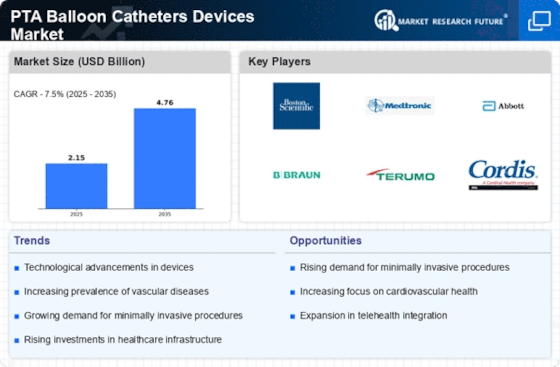

Growing Awareness and Education

There is a notable increase in awareness and education regarding the benefits of PTA balloon catheter procedures among both healthcare professionals and patients. Educational initiatives aimed at highlighting the advantages of minimally invasive techniques are contributing to a shift in treatment paradigms. As more practitioners become informed about the efficacy of PTA balloon catheters, the adoption rates are expected to rise. This growing awareness is likely to propel the PTA Balloon Catheters Devices Market, as patients increasingly seek out these advanced treatment options for their cardiovascular conditions.

Regulatory Support and Approvals

Regulatory bodies are playing a pivotal role in shaping the PTA Balloon Catheters Devices Market by streamlining the approval processes for new devices. Recent initiatives aimed at expediting the review of innovative medical technologies have led to a more favorable environment for manufacturers. This regulatory support not only encourages the development of advanced PTA balloon catheters but also instills confidence among healthcare providers regarding the safety and efficacy of these devices. As a result, the market is likely to witness an influx of new products, enhancing competition and ultimately benefiting patients through improved treatment options.

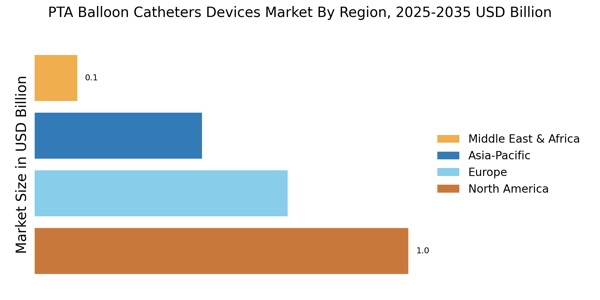

Rising Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver for the PTA Balloon Catheters Devices Market. Many regions are witnessing an expansion of healthcare facilities, particularly in emerging markets, which is enhancing access to advanced medical technologies. This investment is not only improving the availability of PTA balloon catheters but also fostering an environment conducive to the adoption of innovative treatment methods. As healthcare systems evolve and expand, the PTA Balloon Catheters Devices Market is poised for growth, driven by the increasing accessibility of these essential medical devices.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a critical driver for the PTA Balloon Catheters Devices Market. According to recent statistics, cardiovascular diseases account for a substantial percentage of global mortality rates, prompting a greater need for effective treatment solutions. As the population ages and lifestyle-related health issues become more prevalent, the demand for minimally invasive procedures, such as those utilizing PTA balloon catheters, is expected to rise. This trend indicates a growing market for these devices, as healthcare systems seek to address the increasing burden of cardiovascular conditions through innovative and effective interventions.

Technological Innovations in PTA Balloon Catheters

The PTA Balloon Catheters Devices Market is experiencing a surge in technological innovations that enhance the efficacy and safety of procedures. Advanced materials and designs are being developed, which improve the performance of balloon catheters. For instance, the introduction of drug-coated balloons has shown promise in reducing restenosis rates, thereby increasing patient outcomes. Furthermore, the integration of imaging technologies, such as intravascular ultrasound, allows for better visualization during procedures, leading to more precise interventions. As these technologies continue to evolve, they are likely to drive the PTA Balloon Catheters Devices Market forward, attracting both healthcare providers and patients seeking effective treatment options.