Adoption of NFC Technology

Near Field Communication (NFC) technology is a cornerstone of the Proximity Mobile Payment Market. This technology enables secure and instantaneous transactions between devices, which is crucial for the functionality of mobile payment systems. As of 2025, it is estimated that NFC-enabled devices account for over 50% of all smartphones in circulation. The widespread adoption of NFC technology is facilitating the seamless integration of mobile payments into various sectors, including retail, transportation, and hospitality. Furthermore, the increasing number of merchants equipped with NFC terminals is enhancing the accessibility of mobile payment options for consumers. This trend suggests a robust growth trajectory for the Proximity Mobile Payment Market, as more users embrace the convenience of NFC-enabled transactions.

Increased Smartphone Penetration

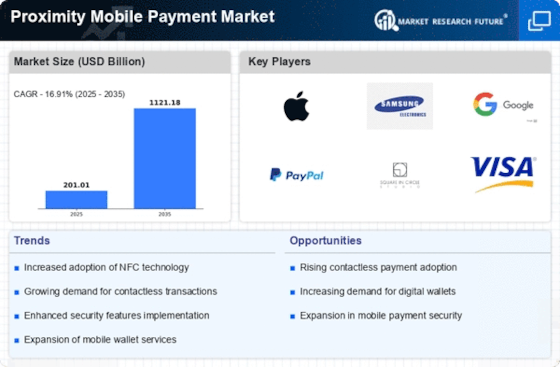

The proliferation of smartphones has been a pivotal driver in the Proximity Mobile Payment Market. As of 2025, it is estimated that over 80% of the population in developed regions owns a smartphone, facilitating the adoption of mobile payment solutions. This trend is further supported by advancements in mobile technology, which enhance user experience and security. The convenience of using smartphones for transactions has led to a significant increase in contactless payments, with projections indicating that the market could reach a valuation of 1 trillion dollars by 2026. Consequently, the integration of mobile payment systems into everyday transactions is becoming increasingly prevalent, thereby propelling the growth of the Proximity Mobile Payment Market.

Consumer Preference for Convenience

Consumer behavior is shifting towards convenience, which is a major driver in the Proximity Mobile Payment Market. As individuals seek faster and more efficient payment methods, mobile payments have emerged as a preferred option. Surveys indicate that nearly 70% of consumers express a desire for quicker transaction processes, which mobile payments can provide. This preference is particularly evident in retail environments, where speed and efficiency are paramount. The ability to complete transactions with a simple tap or scan not only enhances the shopping experience but also encourages repeat usage. As a result, businesses are increasingly adopting mobile payment solutions to meet consumer demands, thereby fostering growth in the Proximity Mobile Payment Market.

Regulatory Support for Digital Payments

Regulatory frameworks are evolving to support the growth of the Proximity Mobile Payment Market. Governments are recognizing the importance of digital payments in driving economic growth and enhancing financial inclusion. Initiatives aimed at promoting cashless transactions are being implemented, with many countries establishing guidelines to ensure the security and efficiency of mobile payment systems. For instance, regulations that mandate the use of secure payment gateways and data protection measures are becoming commonplace. This regulatory support not only instills consumer confidence but also encourages businesses to adopt mobile payment solutions. As a result, the Proximity Mobile Payment Market is likely to experience accelerated growth as compliance with these regulations becomes more widespread.

Rise of E-commerce and Omnichannel Retailing

The expansion of e-commerce and the rise of omnichannel retailing are significantly influencing the Proximity Mobile Payment Market. As consumers increasingly engage in online shopping, the demand for seamless payment solutions has surged. In 2025, e-commerce sales are projected to surpass 5 trillion dollars, highlighting the need for efficient mobile payment options. Retailers are integrating mobile payment systems into their omnichannel strategies to provide a cohesive shopping experience across various platforms. This integration not only enhances customer satisfaction but also drives sales, as consumers are more likely to complete purchases when offered convenient payment methods. Consequently, the growth of e-commerce and omnichannel retailing is expected to propel the Proximity Mobile Payment Market forward.