Aging Population and Associated Health Issues

The demographic shift towards an aging population is significantly influencing the Proton Pump Inhibitors Market. Older adults are more susceptible to gastrointestinal disorders, including peptic ulcers and GERD, which often require long-term management. As the global population aged 65 and above continues to grow, the demand for PPIs is expected to rise correspondingly. Data indicates that individuals over 60 are more likely to be prescribed PPIs, as they often have multiple comorbidities that necessitate effective gastrointestinal management. This trend suggests a sustained increase in the Proton Pump Inhibitors Market, as healthcare systems adapt to the needs of an aging demographic. The implications for pharmaceutical companies are profound, as they may need to focus on developing formulations that cater specifically to this age group.

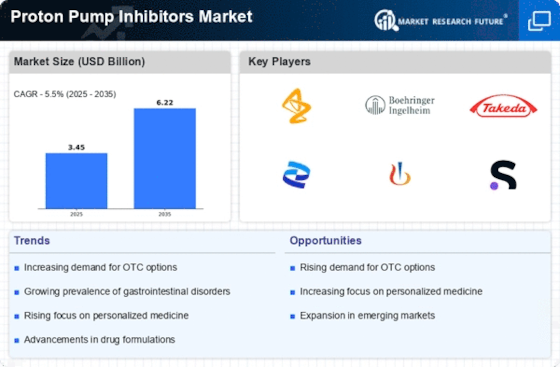

Expansion of Over-the-Counter PPI Availability

The shift towards over-the-counter (OTC) availability of proton pump inhibitors is a significant driver for the Proton Pump Inhibitors Market. This trend allows consumers to access these medications without a prescription, thereby increasing their usage. The introduction of OTC PPIs has made it easier for individuals experiencing mild to moderate GERD symptoms to self-manage their condition. Market data indicates that the OTC segment is growing rapidly, with sales of OTC PPIs contributing substantially to overall market revenue. This accessibility not only enhances patient convenience but also encourages adherence to treatment regimens. As more consumers opt for OTC options, the Proton Pump Inhibitors Market is likely to experience a notable expansion, reflecting changing consumer behaviors and preferences.

Technological Advancements in Drug Development

Technological advancements in drug development are playing a crucial role in shaping the Proton Pump Inhibitors Market. Innovations in pharmaceutical research have led to the creation of new PPI formulations that offer improved efficacy and safety profiles. These advancements may include extended-release formulations and combination therapies that enhance the therapeutic effects of PPIs. Market data suggests that the introduction of novel formulations is driving competition among pharmaceutical companies, leading to a broader range of options for healthcare providers and patients. As these technologies continue to evolve, they are likely to attract investment and research efforts, further propelling the growth of the Proton Pump Inhibitors Market. The potential for enhanced patient outcomes through innovative drug development is a key factor in the industry's future trajectory.

Increasing Prevalence of Gastroesophageal Reflux Disease

The rising incidence of gastroesophageal reflux disease (GERD) is a primary driver for the Proton Pump Inhibitors Market. GERD affects a substantial portion of the population, with estimates suggesting that approximately 20% of adults experience symptoms. This condition necessitates effective treatment options, leading to a heightened demand for proton pump inhibitors (PPIs). As awareness of GERD increases, patients are more likely to seek medical advice, resulting in a surge in prescriptions for PPIs. The Proton Pump Inhibitors Market is thus poised for growth, as healthcare providers increasingly recognize the efficacy of these medications in managing GERD symptoms. Furthermore, the long-term use of PPIs for chronic conditions may contribute to sustained market demand, indicating a robust future for the industry.

Rising Awareness and Education on Gastrointestinal Health

There is a notable increase in awareness and education regarding gastrointestinal health, which is positively impacting the Proton Pump Inhibitors Market. Public health campaigns and educational initiatives have led to greater recognition of conditions like GERD and peptic ulcers. As patients become more informed about their health, they are more likely to seek treatment options, including PPIs. This trend is reflected in market data, which shows a steady increase in PPI prescriptions over recent years. Furthermore, healthcare providers are increasingly emphasizing the importance of gastrointestinal health, further driving demand for effective treatments. The Proton Pump Inhibitors Market stands to benefit from this heightened awareness, as it encourages proactive health management among patients.