Advancements in Biotechnology

Technological advancements in biotechnology are propelling the Global Protein Therapeutics Market Industry forward. Innovations in genetic engineering, protein design, and production techniques are enhancing the development of novel therapeutics. For instance, the advent of CRISPR technology allows for precise modifications in protein structures, leading to more effective treatments. This progress is expected to contribute to a compound annual growth rate of 5.9% from 2025 to 2035. As biotechnology continues to evolve, it is likely that new protein-based therapies will emerge, further expanding the market and addressing unmet medical needs.

Rising Prevalence of Chronic Diseases

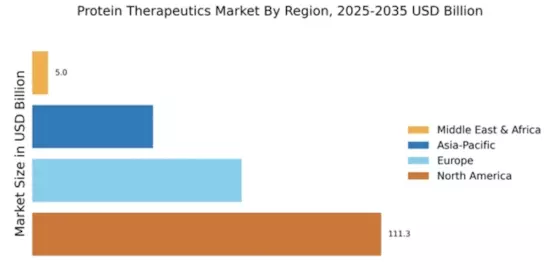

The Global Protein Therapeutics Market Industry is experiencing growth due to the increasing prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders. As of 2024, the market is valued at approximately 239.6 USD Billion, driven by the need for innovative treatment options. Protein therapeutics, including monoclonal antibodies and recombinant proteins, are becoming essential in managing these conditions. The demand for targeted therapies is likely to rise, as they offer improved efficacy and reduced side effects compared to traditional treatments. This trend suggests a robust future for the industry, potentially reaching 450 USD Billion by 2035.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the Global Protein Therapeutics Market Industry. Patients increasingly seek treatments tailored to their genetic profiles, which enhances therapeutic efficacy and minimizes adverse effects. This trend is evident in the rising approval rates of biologics that target specific patient populations. As the market evolves, the demand for protein therapeutics that align with personalized treatment approaches is expected to grow. This could potentially drive the market to reach 450 USD Billion by 2035, as healthcare systems adapt to more individualized care models.

Increasing Investment in Research and Development

Investment in research and development is a critical driver for the Global Protein Therapeutics Market Industry. Pharmaceutical companies are allocating substantial resources to discover and develop new protein therapeutics. In 2024, the market is projected to be valued at 239.6 USD Billion, reflecting the industry's commitment to innovation. Governments and private entities are also funding initiatives aimed at accelerating the development of biologics. This influx of capital is likely to enhance the pipeline of protein therapeutics, ultimately leading to a more diverse range of treatment options for patients and contributing to market growth.

Regulatory Support and Streamlined Approval Processes

Regulatory support is fostering growth in the Global Protein Therapeutics Market Industry. Regulatory agencies are implementing streamlined approval processes for biologics, which facilitates faster market entry for new protein therapeutics. This support is crucial in addressing the urgent need for innovative treatments in various therapeutic areas. As the market continues to expand, the anticipated compound annual growth rate of 5.9% from 2025 to 2035 underscores the positive impact of regulatory frameworks. The collaborative efforts between industry stakeholders and regulatory bodies are likely to enhance the development and availability of protein therapeutics.