Diverse Product Offerings

The diversification of product offerings within The Global Protein Supplements Industry appears to be a crucial driver of growth. Manufacturers are increasingly introducing a variety of protein sources, including whey, casein, soy, and pea protein, to cater to the diverse dietary preferences of consumers. This trend is particularly relevant as the market witnesses a shift towards plant-based proteins, which are gaining traction among health-conscious individuals. Recent statistics suggest that plant-based protein supplements are expected to capture a significant share of the market, potentially accounting for over 30% of total sales by 2025. This variety not only meets consumer demand but also enhances market competitiveness.

Expansion of Fitness Culture

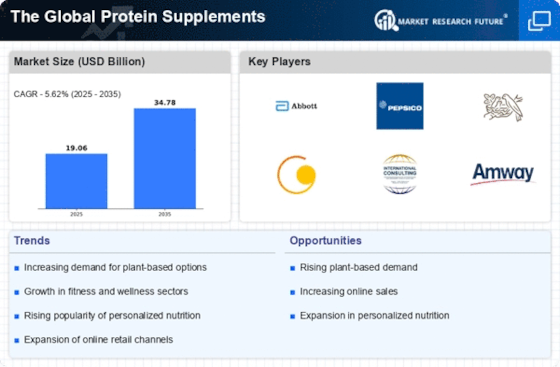

The proliferation of fitness culture globally seems to be a significant catalyst for The Global Protein Supplements Industry. With the increasing popularity of gyms, fitness classes, and wellness programs, more individuals are engaging in regular physical activity. This shift in lifestyle has led to a heightened interest in protein supplementation to support muscle recovery and growth. Market data indicates that the demand for protein supplements among athletes and fitness enthusiasts is expected to rise, potentially reaching a valuation of over 20 billion dollars by 2026. This growing fitness culture not only drives sales but also encourages innovation in product offerings, catering to diverse consumer preferences.

Increasing Health Consciousness

The rising awareness regarding health and wellness among consumers appears to be a pivotal driver for The Global Protein Supplements Industry. Individuals are increasingly prioritizing their nutritional intake, leading to a surge in demand for protein supplements. According to recent data, the protein supplement market is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend is particularly evident among fitness enthusiasts and those seeking to maintain a balanced diet. The emphasis on preventive healthcare and the desire for improved physical performance are likely to further propel the market, as consumers seek products that align with their health goals.

Rising Demand for Convenience Foods

The increasing demand for convenience foods is emerging as a notable driver for The Global Protein Supplements Industry. As lifestyles become busier, consumers are seeking quick and easy nutritional solutions that fit their on-the-go lifestyles. Protein supplements, particularly ready-to-drink shakes and bars, are gaining popularity as convenient meal replacements or snacks. Market analysis indicates that the ready-to-drink segment is projected to grow significantly, potentially accounting for a substantial portion of the overall market share. This trend reflects a broader shift towards convenience in food consumption, which is likely to continue influencing consumer purchasing behavior in the protein supplement sector.

Technological Advancements in Product Development

Technological advancements in product development are likely to play a transformative role in The Global Protein Supplements Industry. Innovations in formulation and processing techniques are enabling manufacturers to create high-quality protein supplements that are more effective and appealing to consumers. For instance, advancements in flavoring and texture enhancement are making protein powders more palatable, thus broadening their appeal. Additionally, the integration of smart technology in product packaging, such as QR codes for nutritional information, is enhancing consumer engagement. As a result, the market is expected to witness a surge in new product launches, further stimulating growth and attracting a wider audience.