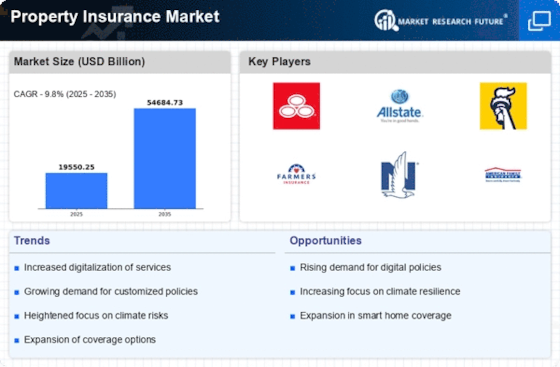

Top Industry Leaders in the Property Insurance Market

Competitive Landscape of the Property Insurance Market

The property insurance market is a dynamic and vibrant arena, teeming with established giants and nimble newcomers vying for market share. Understanding this competitive landscape is crucial for both insurers and policymakers alike. This analysis delves into the key players, their strategies, market share factors, and emerging trends shaping the future of this vital sector.

Key Players :

- State Farm Mutual Automobile Insurance Company

- Chubb

- Allianz

- Zurich

- American International Group, Inc.

- PICC

- Liberty Mutual Insurance

- Allstate Insurance Company

- Admiral Group Plc

- AXA

Strategies for Success:

- Product Differentiation: Insurers constantly refine their offerings, from parametric insurance for weather events to cyber-attack coverage for businesses. Niche specialization and customization are key differentiators.

- Technological Innovation: AI-powered underwriting, automated claims processing, and personalized risk assessments are revolutionizing the industry. Harnessing data analytics for risk pricing and customer profiling is paramount.

- Distribution Channels: Balancing traditional agent networks with digital platforms is crucial. Omnichannel experiences that seamlessly blend online and offline touchpoints are becoming the norm.

- Partnerships & Acquisitions: Strategic collaborations with technology companies, home security providers, and even retail giants like Amazon expand reach and offer bundled solutions. Mergers and acquisitions are common tactics for market consolidation and talent acquisition.

Market Share Analysis:

Several factors influence market share dynamics:

- Pricing Competitiveness: Cost remains a primary driver for many customers. D2C and regional players often challenge traditional carriers on price, although factors like coverage level and risk profile also play a role.

- Brand Reputation & Customer Service: Trust and reliability are vital for long-term relationships. Positive claims experiences and proactive customer engagement foster loyalty and brand advocacy.

- Distribution Reach & Channel Effectiveness: Broad agent networks still hold sway in certain segments, while online platforms cater to digitally savvy customers. Optimizing distribution channels for target demographics is crucial.

- Product Innovation & Risk Expertise: Offering tailored solutions for specific property types or emerging risks like climate change can attract niche segments and enhance brand image.

New & Emerging Players:

Several categories of new entrants are shaking up the landscape:

- Insurtech Startups: Leveraging innovative technologies like blockchain and telematics, these startups offer niche products, simplified processes, and data-driven risk assessment.

- Captive Insurers: Large corporations are setting up captive insurance units to cover their own risks, potentially bypassing traditional carriers in specific segments.

- Alternative Risk-Transfer Mechanisms: Parametric insurance linked to weather indices or catastrophe bonds are gaining traction for managing specific risks.

Current Investment Trends:

Insurers are actively investing in several areas:

- Artificial Intelligence (AI): Chatbots, fraud detection, and automated underwriting are areas of heavy investment.

- Internet of Things (IoT): Smart home devices and sensor-based risk assessment are transforming property insurance.

- Cybersecurity: Protecting against cyberattacks on property management systems and critical infrastructure is a growing concern.

- Climate Change Adaptation: Developing products and services to mitigate the impact of climate-related events like floods and wildfires is becoming increasingly important.

Latest Industry News:

Jan 26, 2024: Increased catastrophe losses and concerns about climate change are driving up reinsurance costs, impacting smaller insurers who rely heavily on this risk-sharing mechanism. This could lead to higher premiums for certain property insurance policies.

Jan 24, 2024: The California Department of Insurance has approved a pilot program for parametric earthquake insurance, which pays out based on the intensity of an earthquake rather than actual damage. This could provide faster financial support to insured homeowners after a quake.

Jan 23, 2024: Lemonade is offering discounts on property insurance for customers who use Google Nest devices for things like smoke detectors and water leak sensors. This potentially incentivizes smart home adoption and improves risk assessment for insurers.

Jan 20, 2024: The Florida property insurance market faces significant challenges due to rising costs and limited availability. Legislators are discussing reforms to address these issues, including potential changes to roof replacement laws and litigation practices.

Jan 18, 2024: Aon's 2024 Global Insurance Market Insights report predicts that the property insurance market will continue to harden, with rising premiums and stricter underwriting guidelines. This is attributed to factors like increased catastrophe losses, inflation, and climate change concerns.