Market Trends

Introduction

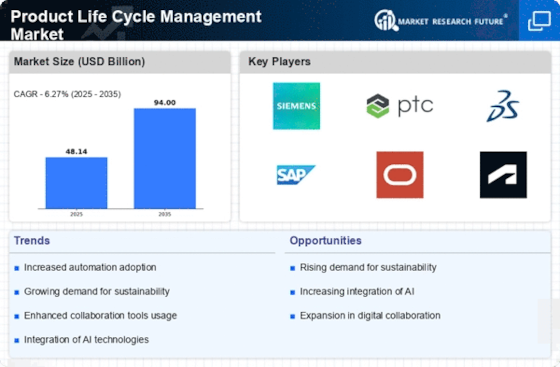

The Product Lifecycle Management (PLM) market is experiencing a major transformation in 2023, driven by a combination of macroeconomic factors such as rapid technological development, growing regulatory pressures and changing customer behavior. Artificial intelligence, machine learning and cloud computing are reshaping how organizations manage product data and collaborate across the supply chain. In parallel, stricter regulations are forcing companies to adopt robust PLM solutions to ensure compliance and sustainable development. Moreover, a trend towards individualized and sustainable products is putting pressure on companies to adapt their strategies and strategies. These trends are strategically important for PLM players as they navigate a complex landscape and seek to optimize PLM systems for competitive advantage and operational efficiency.

Top Trends

-

Increased Adoption of AI and Machine Learning

Machine learning and artificial intelligence are revolutionizing PLM by enhancing the predictive capabilities and automating the repetitive tasks. Using the new capabilities, companies like Siemens have been able to reduce time-to-market by as much as 30 percent. Moreover, the trend toward more data-driven decision-making will result in improved operational efficiency and product quality. -

Sustainability and Circular Economy Focus

The concept of sustainability is increasingly becoming a core part of the PLM strategy, with companies concentrating on eco-friendly materials and production processes. Oracle, for example, has developed a tool for tracking carbon footprints in the development of products. This not only meets the requirements of the regulators but also makes for brand loyalty and market differentiation. -

Integration of IoT in PLM Systems

The Internet of Things (IoT) is becoming increasingly integrated into PLM systems. This integration enables the collection and analysis of real-time data. PTC, for example, has been able to monitor the performance of products after their launch and thereby increase customer satisfaction by 25 percent. This trend will make it possible to increase product life cycle visibility and ensure continuous improvement. -

Enhanced Collaboration through Cloud Solutions

Cloud PLM solutions enable a higher degree of collaboration between all the participants in the product life cycle. With Autodesk’s cloud offerings, teams can work on the same design at the same time, which reduces errors by 40 per cent. This trend towards more remote and global collaboration will probably continue and can result in faster innovation cycles. -

Digital Twin Technology Adoption

The digital twin technology is gaining in importance in the PLM area, enabling companies to create virtual replicas of products for testing and improvement. For example, in the field of aeronautics, Dassault Systèmes has implemented digital twins, which have led to a 20 percent reduction in development costs. This trend is expected to enhance the performance of products and reduce the risks associated with physical prototypes. -

Regulatory Compliance Automation

The automation of compliance with industry regulations is becoming an important part of Product Lifecycle Management (PLM), especially in the pharmaceuticals industry. SAP, for example, is developing a solution that can reduce auditing time by 50 per cent. This trend will probably lead to a reduction in the number of fines for non-compliance and to greater efficiency. -

Focus on User Experience in PLM Tools

UX is increasingly being used to design PLM systems. This makes the tools more intuitive and accessible. Infor, for example, has developed its PDM and PLM applications to be more UI-friendly. This has led to a 35% increase in the number of users. This trend is expected to increase productivity and reduce training costs. -

Data Security and Privacy Enhancements

Data security and confidentiality are important concerns in the increasingly interconnected world of PLM. With a view to ensuring the highest possible degree of data security, companies are investing in the most advanced cyber-security measures. Oracle reports a sixty per cent increase in the security features of its PLM solutions. This trend will shape the future of PLM, as it will make sure that sensitive data is kept out of the hands of malicious parties. -

Agile PLM Methodologies

PLM is using agile methods to increase its responsiveness to changes in the market. In companies like Arena Technologies, agile methods are implemented, resulting in a 30% increase in responsiveness to customer feedback. This trend is expected to drive innovation and agility in product development. -

Integration of Blockchain for Traceability

It is being explored to improve traceability in PLM, especially in supply chain management. Companies are using it to guarantee transparency and authenticity, and they are reporting a 50 per cent reduction in counterfeiting. This trend is expected to increase, establishing trust and accountability in the sourcing and manufacturing of products.

Conclusion: Navigating the Product Life Cycle Landscape

In 2023 the Product Lifecycle Management market will be characterized by a high degree of competition and fragmentation. The share of the market is divided between established and new players. The main trends are: a) increased emphasis on sustainability and automation of business processes in order to increase the efficiency of business processes and b) an increased focus on the needs of the end-consumer. Strategically, the vendors are focusing on advanced capabilities, such as artificial intelligence and flexibility, which are becoming key differentiators in this landscape. Strategically, the decision-makers must focus on the integration of these capabilities in order to maintain leadership positions and to ensure innovation and thereby remain competitive in an increasingly complex environment.

Leave a Comment