Product Life Cycle Management Size

Market Size Snapshot

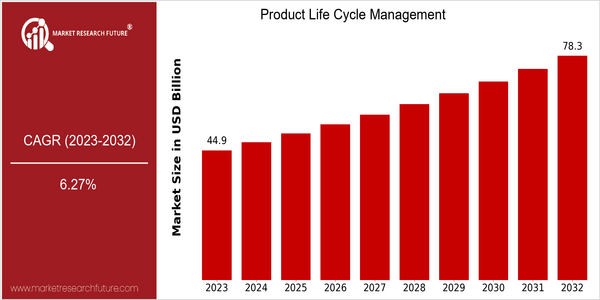

| Year | Value |

|---|---|

| 2023 | USD 44.91 Billion |

| 2032 | USD 78.33 Billion |

| CAGR (2024-2032) | 6.27 % |

Note – Market size depicts the revenue generated over the financial year

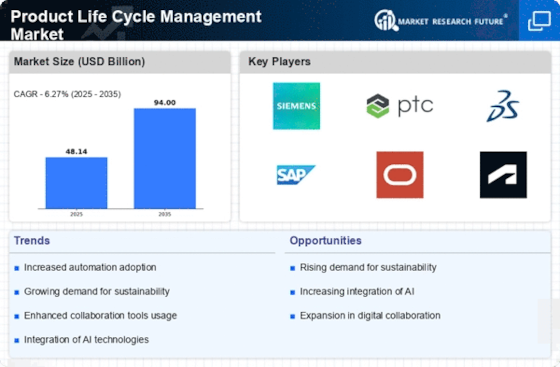

Product Lifecycle Management (PLM) market is valued at about USD 43.91 billion in 2023 and is projected to reach USD 78.33 billion by 2032, at a strong CAGR of 6.81% from 2024 to 2032. This growth indicates a strong demand for PLM solutions as more and more companies are realizing the importance of managing product lifecycles in order to enhance their competitiveness and innovation. The PLM market is primarily driven by several factors, such as the growing complexity of product development processes, the need for regulatory compliance, and the growing number of digital transformation initiatives across industries. Cloud computing, artificial intelligence, and the Internet of Things are also significantly influencing the PLM landscape, enabling companies to improve their operations, collaboration, and data analysis capabilities. The leading PLM solution vendors, such as Siemens, PTC, and Dassault Systèmes, are launching new products and strengthening their market positions by forming strategic alliances. The integration of artificial intelligence into PLM solutions is one such example. By combining PLM with artificial intelligence, Siemens aims to enhance the decision-making and data analysis capabilities of manufacturers and product development teams.

Regional Market Size

Regional Deep Dive

Product Lifecycle Management (PLM) market is experiencing a significant growth across various regions, owing to the increasing need to streamline the product development processes and enhance collaboration among the various stakeholders. The North American market is characterized by the presence of high-tech companies and the high rate of PLM adoption in the manufacturing, automotive, and aerospace industries. Europe is characterized by a wide variety of markets, with a focus on sustainability and regulatory compliance. The Asia-Pacific region is characterized by a fast-paced development, especially in the manufacturing and technology industries. The Middle East and Africa are experiencing a slow but steady adoption, driven by the diversification of economies, while Latin America is beginning to adopt PLM solutions as part of its digital transformation journey.

Europe

- The European Union's Green Deal is driving companies to adopt PLM solutions that support sustainable product development, with organizations like Dassault Systèmes leading the charge in providing eco-friendly PLM tools.

- Recent innovations in digital twin technology are reshaping PLM strategies, allowing companies to simulate product performance and lifecycle management more effectively, as seen in projects by Bosch and Volkswagen.

Asia Pacific

- China's 'Made in China 2025' initiative is significantly influencing the PLM market, encouraging local manufacturers to adopt advanced PLM systems to enhance competitiveness and innovation.

- The growing startup ecosystem in India is fostering innovation in PLM solutions, with companies like Tactycs and Zycus developing tailored PLM applications for various industries.

Latin America

- Brazil's push towards digital transformation in manufacturing is leading to increased interest in PLM solutions, with local firms exploring partnerships with global PLM providers.

- The region's focus on improving supply chain efficiency is driving the adoption of PLM systems, as companies seek to enhance collaboration and reduce time-to-market for new products.

North America

- The rise of Industry 4.0 has led to increased investments in PLM solutions, with companies like Siemens and PTC enhancing their offerings to integrate IoT and AI capabilities.

- Regulatory changes, particularly in the automotive sector, are pushing manufacturers to adopt PLM systems that ensure compliance with safety and environmental standards, exemplified by initiatives from the U.S. Environmental Protection Agency.

Middle East And Africa

- The UAE's Vision 2021 is promoting the adoption of advanced technologies, including PLM, to enhance the manufacturing sector, with government support for digital transformation initiatives.

- In South Africa, the mining sector is increasingly leveraging PLM solutions to improve operational efficiency and compliance with environmental regulations, driven by companies like SAP and Oracle.

Did You Know?

“Approximately 70% of product development costs are determined during the design phase, highlighting the critical role of effective PLM in managing product lifecycles.” — Gartner Research

Segmental Market Size

Product Lifecycle Management (PLM) is a growing market. It is driven by a growing need to optimize product development processes and to improve collaboration between teams. In addition, the growing complexity of products requires better management of data and processes, and compliance with regulations in industries such as pharmaceuticals and automobiles is increasingly becoming a concern. Furthermore, technological developments in the field of cloud computing and the Internet of Things are leading to an increasing integration of PLM solutions. At the moment, PLM solutions are already being widely used, and the market is dominated by large companies such as Siemens and PTC, which have already implemented PLM solutions across a wide range of industries. Product data management, collaboration between design and engineering teams, and compliance with regulations and standards are the most important applications. But the market is growing. The main drivers are digital transformation and sustainability initiatives, which are increasingly becoming an important concern for companies that want to be more innovative while reducing their impact on the environment. The evolution of PLM is being driven by new technologies such as artificial intelligence and machine learning, which make it possible to perform predictions and make better decisions.

Future Outlook

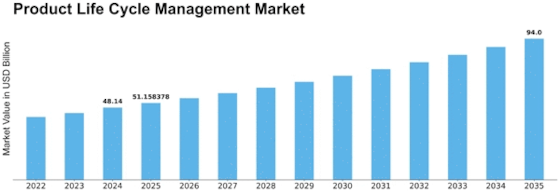

Product Lifecycle Management (PLM) is expected to see significant growth from 2023 to 2032, with an estimated market value from US$44.91 billion to US$78.33 billion, reflecting a robust CAGR of 6.27%. This is driven by the increasing complexity of product development processes and the increasing demand for a single solution that can enhance collaboration throughout the various stages of the product life cycle. In order to increase efficiency and innovation, PLM systems will penetrate further into the manufacturing, automobile and consumer goods industries, with penetration rates of more than 70% in these industries by 2032. Artificial intelligence, machine learning and the Internet of Things are expected to transform the PLM industry, enabling the integration of new capabilities. These include real-time data analysis, predicting the future and enhancing the decision-making process. These will help to improve the efficiency of product development and reduce time-to-market. Furthermore, the growing emphasis on sustainable development and compliance with regulations will drive the demand for PLM solutions that can facilitate eco-friendly practices and adherence to industry standards. These will also enable the industry to evolve towards a more sustainable business model.

Leave a Comment