Top Industry Leaders in the Process Spectroscopy Market

The Competitive Landscape of the Process Spectroscopy Market

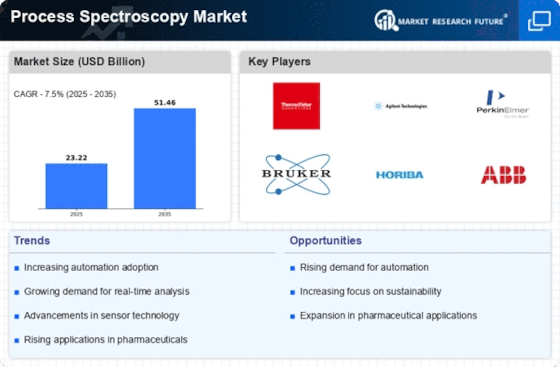

The process spectroscopy market, a multi-billion dollar symphony of light and molecules, is far from a single note. It's a vibrant orchestra of established giants, nimble niche players, and technological innovators, all vying for dominance in analyzing and optimizing industrial processes. To understand this intricate composition, let's delve into the strategies powering the competition, the factors influencing market share, and the new instruments joining the ensemble.

Key Player:

- ABB Ltd.

- Shimadzu Corporation

- Agilent Technologies, Inc.

- Sartorius AG

- Bruker Corporation

- Kett Electric Laboratory

- Buchi Labortechnik AG

- Horiba Limited

- Danaher Corporation

- Foss A/S.

Strategies Adopted by Leaders:

- Technological Prowess: Industry titans leverage their extensive R&D capabilities to pioneer cutting-edge spectroscopic techniques. They offer sophisticated analyzers for diverse applications, catering to complex process needs and pushing the boundaries of analytical accuracy.

- Specialized Solutions: Companies their niche by focusing on specific sectors like pharmaceuticals or food & beverage. They develop specialized instruments and software tailored to the unique challenges of these industries, offering deep expertise and targeted solutions.

- Cost-Effectiveness Chorus: Emerging companies like ABB and Mettler Toledo woo cost-conscious customers with competitively priced spectrometers. They prioritize user-friendliness and robust design, making spectroscopy accessible to smaller businesses and emerging markets.

- Digital Symphony: Companies integrate their spectrometers with advanced process control systems and data analytics platforms. This fosters real-time process monitoring, predictive maintenance, and data-driven optimization, appealing to industries seeking automation and efficiency.

Factors for Market Share Analysis:

- Market Segmentation: The process spectroscopy market isn't a monolithic entity. It's divided into segments like infrared, Raman, and ultraviolet spectroscopy, each catering to specific types of analyses and industries. Understanding these nuances is crucial for accurate market share analysis.

- Regional Variations: Demand patterns and technological adoption differ across regions. For instance, the pharmaceutical industry in North America may drive demand for high-resolution mass spectrometers, while the chemical industry in Asia may favor cost-effective infrared analyzers.

- Regulatory Landscape: Stringent regulations on product quality and environmental emissions fuel the demand for advanced spectroscopic solutions. Companies that adapt their instruments to comply with evolving regulations gain a competitive edge.

- Industry Trends: Emerging trends like Industry 4.0 and digital transformation push for integration of spectroscopy with automation, artificial intelligence, and big data analytics. Companies that embrace these trends and develop solutions that facilitate data-driven decision making stand to benefit.

New and Emerging Companies:

- Portable Spectroscopy Startups: Companies like Viavi Solutions and Rigaku Analytical Instruments are developing compact, portable spectrometers for on-site analysis. This empowers real-time process monitoring in remote locations and eliminates the need for sample transportation.

- Hyperspectral Imaging Specialists: Companies like Specim and Headwall Photonics offer cutting-edge hyperspectral imaging systems, providing detailed spatial information about chemical composition within samples. This technology aids in process optimization and quality control in various industries.

- AI-Powered Spectroscopy Solutions: Startups like Apisight and Chemant are leveraging artificial intelligence to automate data interpretation and develop intelligent spectroscopic platforms. These solutions simplify analysis, improve accuracy, and enable real-time process insights for non-expert users.

Latest Company Updates:

ABB Ltd.

-

October 2023: ABB launches the Lumex DS200 series of near-infrared spectrometers (NIR) specially designed for the food and beverage industry. These compact and robust instruments offer rapid and accurate analysis of key parameters like moisture, fat, and sugar content for real-time process control and product quality assurance. -

September 2023: ABB partners with Siemens to develop a joint offering for integrated process analytics and process control in the chemical industry. This collaboration brings together ABB's expertise in spectroscopy and automation with Siemens' process control systems, aiming to create a comprehensive solution for optimizing production efficiency and product quality.

Shimadzu Corporation

-

January 2024: Shimadzu showcases its new XRF (X-ray fluorescence) spectrometer model, the EDX-G8000, at the Pittcon conference. This high-sensitivity instrument promises rapid and non-destructive elemental analysis of a wide range of materials, catering to industries like mining, metal refining, and electronics manufacturing. -

December 2023: Shimadzu unveils a new software platform, LabSolutions Insight, for integrated data analysis and reporting across its spectroscopy product line. This platform simplifies data management, visualization, and interpretation, helping users gain deeper insights from their analytical results.