Growth in Pharmaceutical Applications

The pharmaceutical sector's expansion significantly influences the Atomic Spectroscopy Market. With the increasing complexity of drug formulations and the necessity for precise quality control, atomic spectroscopy techniques are becoming indispensable. The market for atomic spectroscopy in pharmaceuticals is expected to witness a notable increase, driven by the need for stringent testing of raw materials and finished products. The ability of atomic spectroscopy to provide accurate elemental analysis ensures compliance with regulatory standards, which is crucial for pharmaceutical companies. As the industry continues to innovate and develop new therapies, the reliance on atomic spectroscopy for quality assurance is likely to grow, enhancing the market's prospects.

Increasing Applications in Food Safety

The focus on food safety and quality assurance is a significant driver for the Atomic Spectroscopy Market. With rising consumer awareness regarding food contaminants and nutritional content, regulatory bodies are enforcing stricter testing protocols. Atomic spectroscopy techniques are widely employed to detect heavy metals and other harmful substances in food products. The market for atomic spectroscopy in food safety is anticipated to grow as food manufacturers and regulatory agencies prioritize consumer health. This trend underscores the importance of reliable analytical methods in ensuring food safety, thereby fostering the adoption of atomic spectroscopy techniques in the food industry.

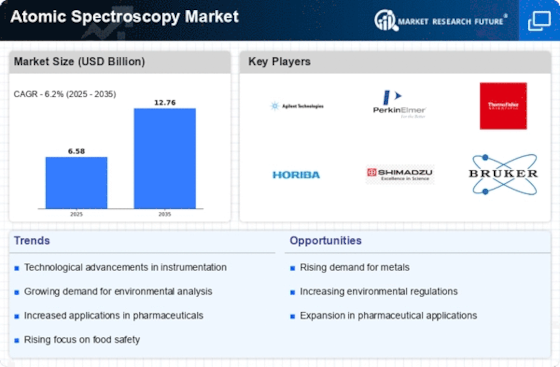

Rising Demand in Environmental Testing

The increasing emphasis on environmental protection and compliance with regulations drives the Atomic Spectroscopy Market. Governments and organizations are mandating stringent testing of pollutants in air, water, and soil. This trend is evident as the market for atomic spectroscopy instruments is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. The need for accurate and reliable analytical methods to detect trace elements and contaminants is paramount, leading to heightened demand for atomic spectroscopy techniques. As industries strive to meet environmental standards, the adoption of atomic spectroscopy for environmental monitoring is likely to expand, thereby bolstering the market.

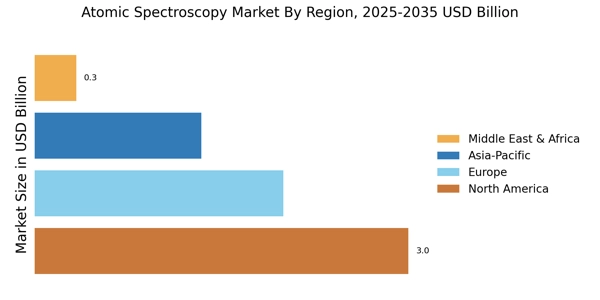

Emerging Markets and Research Initiatives

Emerging markets are presenting new opportunities for the Atomic Spectroscopy Market. As developing countries invest in research and development, the demand for advanced analytical techniques is on the rise. Academic institutions and research organizations are increasingly adopting atomic spectroscopy for various applications, including materials science and environmental studies. This trend is likely to stimulate market growth as these regions enhance their analytical capabilities. Furthermore, government initiatives aimed at promoting scientific research and innovation are expected to bolster the adoption of atomic spectroscopy technologies, contributing to the overall expansion of the market.

Advancements in Instrumentation Technology

Technological innovations in instrumentation are propelling the Atomic Spectroscopy Market forward. The development of more sensitive, faster, and user-friendly atomic spectroscopy instruments is enhancing analytical capabilities across various sectors. For instance, the introduction of high-resolution spectrometers and automated systems is streamlining workflows and improving data accuracy. These advancements are expected to attract a broader range of users, including those in academia and research institutions. As the demand for sophisticated analytical techniques increases, the market for atomic spectroscopy instruments is likely to expand, reflecting the ongoing evolution of technology in analytical chemistry.