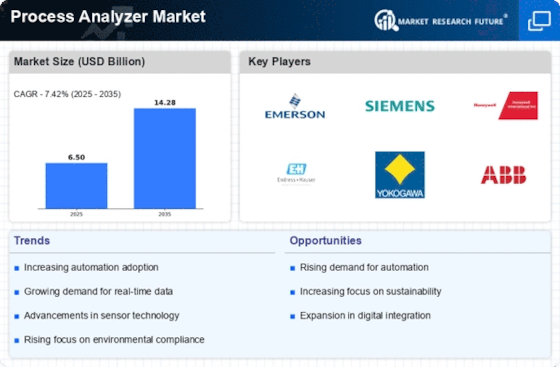

Leading market players are investing heavily in research and development to expand their product lines, which will help the process analyzer market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the process analyzer industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the global process analyzer industry to benefit clients and increase the market sector. Major players in the process analyzer market include Yokogawa Electric Corporation, Emerson Electric Co, Cemtrex, Inc., and AMETEK.Inc., ABB, Endress+Hauser Management AG, Honeywell International Inc., Schneider Electric, SUEZ, Hach, Modcon Systems LTD, and others are attempting to increase market demand by investing in research and development operations.ABB Ltd is a provider of digital technologies. The firm offers products, systems, solutions, and services related to motion, electrification products, and industrial automation. It delivers harness power reliability, increases industrial productivity, and enhances energy efficiency. ABB sells products via a direct sales force and third-party channel partners such as distributors, installers, machine builders, wholesalers, OEMs, and system integrators. It delivers digitally connected and enabled industrial equipment and systems to consumers in utilities, industry, transport, and infrastructure sectors in Asia, the Americas, the Middle East, Africa, and Europe.

In March ABB launched a new range of color-coded sensors that make it easy to choose and manage the optimal pH measurement solution. The sensors will assist in analyzing the pH level of water more effectively.Emerson Electric Co provides innovative solutions for customers in commercial, industrial, and residential markets. The company offers measurement and analytical instrumentation, industrial valves, equipment, process control software and systems, fluid control, pneumatic mechanisms, electrical distribution equipment, and other products. It also provides modernization and migration, process automation, smart wireless, consulting, training, and after-project support services. The company markets its products under Emerson, Grind2Energy, InSinkErator, Badger, ProTeam, and RIDGID.

In July Emerson introduced two new Rosemount 628 Universal Gas Sensors to measure carbon monoxide and oxygen depletion and the existing capability to monitor hydrogen sulfide.These additions to the series cover a wider range of hazardous situations that can be monitored utilizing the Rosemount 928 Wireless Gas Monitor platform.