Top Industry Leaders in the Private Narrowband IoT Market

Competitive Landscape of Private Narrowband IoT Market

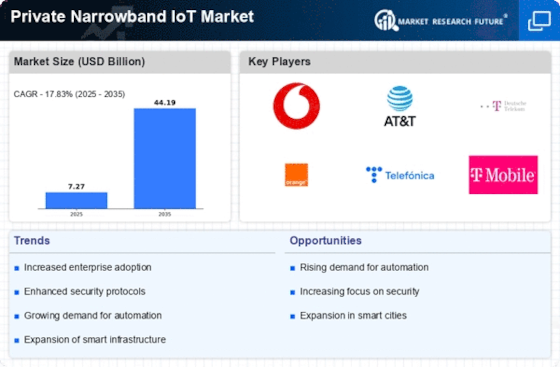

The private Narrowband IoT (NB-IoT) market is showcasing significant growth potential, driven by the increasing demand for low-power wide-area connectivity solutions across diverse industries. This market presents a dynamic landscape with established players vying for dominance alongside emerging companies introducing innovative solutions. Understanding the competitive landscape is crucial for stakeholders seeking to capitalize on this burgeoning market.

Key Players:

- AT&T

- Verizon Communications

- China Mobile Limited

- Huawei technologies co. Ltd.

- Intel Corporation

- Telefónica

- Vodafone Group Plc.

- Orange

- China Unicom

- Telstra

- Nokia

- Ericsson

- Qualcomm Technologies Inc

- Telecom Italia

- Emirates Telecommunications Corporation

Strategies Adopted:

Key players are adopting diverse strategies to gain market share in the private NB-IoT market. These strategies include:

- Network infrastructure expansion: Telecommunication companies are investing heavily in expanding their NB-IoT network infrastructure to provide wider coverage and improved connectivity.

- Strategic partnerships: Companies are collaborating with each other to leverage their respective strengths and offer comprehensive solutions.

- Product innovation: Focus on developing new and innovative NB-IoT chipsets, modules, and software solutions to cater to specific industry needs.

- Vertical market focus: Targeting specific industries, such as energy, utilities, manufacturing, and agriculture, with tailored solutions.

- Aggressive pricing: Offering competitive pricing strategies to attract customers and expand market reach.

- M&A activity: Increasing mergers and acquisitions to consolidate market share and gain access to new technologies and resources.

Factors for Market Share Analysis:

Several key factors influence market share analysis in the private NB-IoT market:

- Network coverage: The extent of NB-IoT network coverage offered by a company significantly impacts its market share.

- Product portfolio: A diverse and comprehensive product portfolio catering to various applications and industries enhances market share.

- Technology leadership: Companies at the forefront of NB-IoT technology development are more likely to gain market share.

- Customer base: A strong and loyal customer base provides a solid foundation for market share growth.

- Brand reputation: A well-established brand reputation in the telecommunications industry fosters trust and attracts customers.

New and Emerging Companies:

Several new and emerging companies are entering the private NB-IoT market with innovative solutions:

- Drover AI: Provides AI-powered solutions for livestock tracking and management using NB-IoT.

- Evrythng: Offers a platform for connecting physical objects to the digital world using NB-IoT.

- Actility: Develops a low-power wide-area network technology called LoRaWAN, which competes with NB-IoT.

- OrCam: Creates assistive technology solutions for the visually impaired using NB-IoT connectivity.

- Losant: Provides an Internet of Things (IoT) platform for building and managing NB-IoT applications.

Current Company Investment Trends:

Companies operating in the private NB-IoT market are focusing on key investment areas:

- Research & Development: Investing heavily in R&D to develop new technologies and solutions for the evolving NB-IoT market.

- Network infrastructure: Expanding network infrastructure to improve coverage and capacity.

- Partnerships: Collaborating with other companies to broaden their reach and expertise.

- Marketing & Sales: Increasing marketing and sales efforts to promote their NB-IoT solutions and reach new customers.

- Talent acquisition: Recruiting skilled professionals with expertise in NB-IoT technology and related fields.

Latest Company Updates:

The Indian IoT firm Proxgy has added the Kadi smartwatch to its line of products in 2023. This UPI-enabled wristwatch is intended for the portion of Indian society—street sellers and hawkers—that has not yet completely embraced this digital revolution.

Taiwanese advanced metering infrastructure (AMI) and private network operator Ubiik purchased New Zealand-based Mimomax Wireless, a developer of industrial IoT solutions, in 2023 for an unknown sum. According to the two, the agreement established a "leading-edge wireless solutions supplier for utilities and vital infrastructure." According to Ubik, it will quicken its own market penetration and expand its private LTE product line among Mimomax's vital global clientele.

This April, the first-ever satellite under the 3GPP 5G NB-IoT NTN Release 17 standard will be launched into space by Sateliot, the first company to operate a low-Earth orbit (LEO) nanosatellite constellation with 5G-IoT standard coverage in 2023. Following a paradigm shift in the telecom sector, this standard is being used in satellite telecommunications. Currently, devices from the same business are the only ones that can be connected to non-terrestrial networks (NTNs) that are managed by legacy satellite carriers and use proprietary technology.